Venezuela is positioned at the center of a potential oil investment boom, with vast reserves that attract significant interest from US oil companies. Despite President Trump’s strong push for their involvement, the prospects of investing in Venezuela oil investment are rife with uncertainty. The country claims to have over 300 billion barrels of oil, particularly heavy crude oil that has specific refining challenges. While the allure of tapping into these abundant resources remains, economic realities and an unstable political landscape are causing hesitation among American corporations. As the oil industry engages with this opportunity, it will need to navigate complex logistical and geopolitical issues to determine if this venture is worth the risk.

The possibility of capitalizing on Venezuela’s oil wealth is drawing attention from various sectors, particularly from those within the American petroleum industry. With a prominent focus on entering the South American country’s oil market, stakeholders must consider the myriad of challenges associated with investing in such a complex environment. This engagement with Venezuela’s extensive crude oil reserves beckons major oil corporations to weigh the potential returns against the risks involved. Heavy crude oil extraction demands specialized refining capabilities, which could pose additional hurdles for potential investors. As interest surges, the question remains whether pragmatism will trump ambition in the quest to unlock Venezuela’s oil potential.

Venezuela Oil Investment: A Double-Edged Sword for US Companies

The investment landscape in Venezuela is fraught with complexities for US oil companies, especially in light of the country’s political turmoil. While President Trump has been vocal about encouraging these corporations to tap into Venezuela’s substantial oil reserves, estimated to exceed 300 billion barrels, the inherent risks cannot be ignored. Oil giants are wary of committing to investments in a nation where the political climate is unpredictable, and governance remains unstable. Business decisions in the oil sector often hinge not only on potential profits but also on operational viability and risk management, and current conditions in Venezuela significantly complicate this equation.

Heavy crude oil poses another challenge that further complicates potential investments. The type of crude found in Venezuela requires specialized refining capabilities, which are becoming increasingly rare in the US and globally. As Mukesh Shadev pointed out, many refineries are moving away from heavy crude due to changing energy consumption patterns focused on cleaner fuels. Therefore, even if US oil companies decide to invest, they must also consider whether there is enough demand for Venezuelan crude in the future, especially as the global market shifts toward reducing reliance on fossil fuels.

The Future of US Oil Companies in Venezuela

As the political situation evolves, US oil companies face a tough decision regarding entering or re-entering the Venezuelan market. With the Trump administration advocating for a more aggressive stance, many executives are balancing the potential benefits against the daunting risks of doing business in Venezuela. Having been historically reluctant due to governmental changes, corruption, and the lack of infrastructure, the oil industry engagement is under scrutiny. Will companies see this as a long-term investment opportunity, or will they remain on the sidelines as observers?

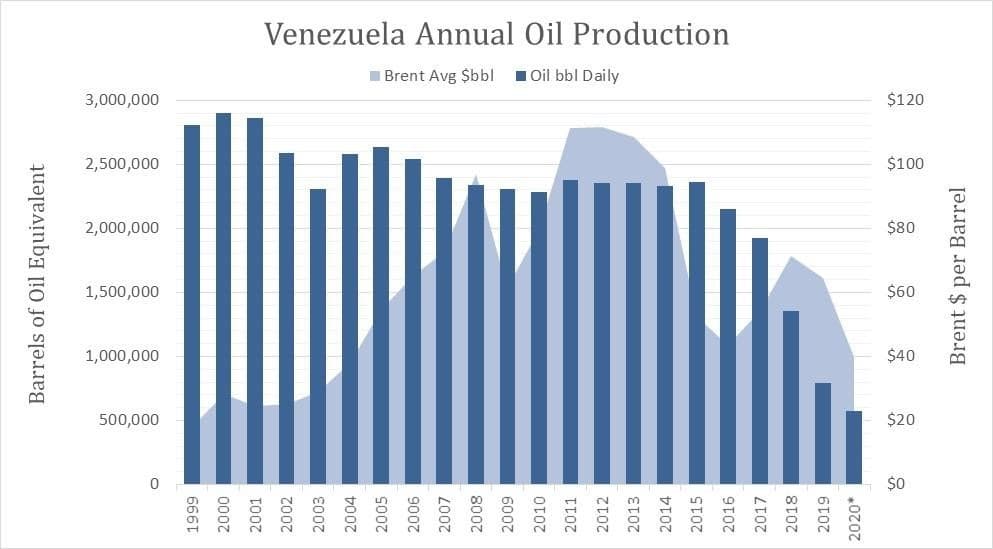

Furthermore, the viability of boosting production from the existing infrastructure in Venezuela is another issue at hand. Industry experts estimate that it could take around $180 billion in investment just to restore production levels to those seen in the 1990s. This reality adds layers of caution among well-established US oil companies, who typically prefer more stable environments with predictable returns. While smaller companies might be willing to experiment with quick fixes for production increases, the major players are likely to wait for a more favorable and stable situation before committing substantial resources.

Understanding Venezuela’s Heavy Crude Oil Dilemma

Heavy crude oil presents a unique set of challenges for refineries and investors alike. Unlike lighter crude types, heavy crude requires extensive processing capabilities that not all refineries possess. This raises concerns about the ability of US oil companies to leverage Venezuelan resources if the refineries available to them are not equipped to handle the demands of heavy crude processing. Moreover, as the world moves toward cleaner energy sources, investing in heavy crude could be seen as contrary to the trends of de-carbonization and sustainability that many oil companies are now endorsing.

The current global sentiment toward fossil fuels and heavy crude further complicates investment strategies for US oil companies considering Venezuelan investments. Experts suggest that the demand for heavy crude is declining, which diminishes the appeal of Venezuela’s resources, even if the reserves are deemed significant. With increasing pressure to transition towards renewable energy sources, companies must assess not only the financial returns of investing in heavy crude but also their long-term sustainability goals.

The Role of Political Stability in Oil Investment

Political stability is a crucial factor in the decision-making process for US oil companies looking to invest in Venezuela. The administration of President Trump has been adamant about tailoring US foreign policy to ensure that American firms can tap into Venezuelan oil reserves, but the lack of stability in the nation raises significant concerns. Investors typically seek environments where they can expect both safety for their employees and predictable financial returns. Currently, both elements are in question in Venezuela, leading to significant hesitance from major oil companies.

Moreover, any changes in the political landscape can instantly alter the investment climate. Should a transition to a more stable government occur, it may open up opportunities for American companies. However, up to that point, the current risks are likely to deter major investments. Companies must weigh these considerations against potential sanctions and geopolitical tensions that could further impact their ability to operate effectively in Venezuela’s oil-rich environment.

Security Concerns for US Oil Operations in Venezuela

Safety and security concerns are paramount when considering investments in countries plagued by political unrest, as is the case with Venezuela. For US oil companies, ensuring the safety of local employees and operations remains a top priority. Without adequate security measures and political stability, the prospect of successfully tapping into the vast Venezuelan oil reserves feels perilous. The potential for violence, kidnapping, and local unrest could drastically impact operational capacity and profitability.

A robust security framework is necessary for US oil companies wishing to navigate the complexities of operating in Venezuela. Companies must consider not only the physical safety of their employees but also the legal implications of doing business in such a politically charged environment. Failing to establish strong local partnerships or security measures can lead to significant losses, both financially and in terms of human capital.

Economic Viability of Investing in Venezuelan Oil

Evaluating the economic viability of investing in Venezuelan oil involves a multifaceted analysis of market trends, geopolitical factors, and infrastructure capabilities. With an estimated need for $180 billion to revitalize the sector, US oil companies must question the immediacy of returns against the backdrop of long-term global shifts toward renewable energy sources. The overwhelming investment required poses questions about the potential for profit in a market where extraction and refinement present distinct hurdles.

Given the low current production levels compared to historical figures, oil companies must also assess whether the anticipated returns justify the initial expenditures. The answer may vary across companies—while larger firms may decide to wait for better conditions, smaller companies may be more willing to take calculated risks in pursuit of quick gains available from Venezuela’s untapped resources.

Impact of US Sanctions on Venezuela Oil Markets

US sanctions on Venezuela represent a significant hurdle for American oil companies examining investment opportunities. While the intention of these sanctions may be to pressure the Maduro government, they also create barriers that complicate any potential engagements from US firms. These restrictions limit the ability of companies to establish operations and enter joint ventures aimed at revitalizing Venezuela’s oil sector.

As US policy continues to evolve, so too do the impacts on the oil market and corporate strategies. Investors must remain agile and responsive to the geopolitical landscape that informs the viability of entering into an agreement with Venezuela. It raises further questions about future cooperation and the possible lifting of sanctions that may incentivize US oil companies to chart a course into this resource-rich market.

Addressing Environmental Concerns of Venezuelan Oil Production

The extraction and production of oil in Venezuela also carry significant environmental concerns that cannot be overlooked. As the world becomes increasingly aware of climate change and its alarming impacts, oil companies are feeling the pressure to adhere to sustainable practices. The challenges posed by environmental degradation, particularly in sensitive regions like the Orinoco Belt, highlight the responsibility that companies must consider when deciding whether to invest.

Any investment in Venezuelan oil must include comprehensive environmental assessments and sustainable extraction practices. Failing to do so not only risks damaging the local ecosystem but may also lead to reputational harm and financial penalties from both domestic and international regulators. Companies must, therefore, approach Venezuelan oil with a long-term sustainability mindset, balancing profitability with environmental stewardship.

The Strategic Importance of Venezuela’s Oil Reserves

Venezuela holds strategic importance in the global oil landscape due to its vast reserves, which could potentially play a crucial role in energy security for nations outside of the domestic US sphere. Many governments and companies are acutely aware of the geopolitical implications of these reserves and may consider partnerships that would allow them to utilize Venezuelan oil to diversify their energy portfolios. This strategic significance adds another layer of calculation for US oil companies weighing their options.

Nonetheless, the question remains whether US companies can navigate the political and economic intricacies to secure a foothold in Venezuelan oil. The willingness of the US government to engage with Venezuela, coupled with market demands and geopolitical shifts, will ultimately dictate whether this potential can be fully realized. The ability to respond to dynamic circumstances will be essential for any successful strategy involving Venezuela’s oil.

Frequently Asked Questions

Why are US oil companies interested in Venezuela oil investment?

US oil companies are eyeing Venezuela oil investment due to the country’s vast oil reserves, estimated to be over 300 billion barrels. With the world’s largest reserves, Venezuela has the potential to significantly boost US energy resources. However, these companies are cautious due to the political instability and the challenges associated with extracting heavy crude oil from the region.

What challenges do US oil companies face in Venezuela oil investment?

US oil companies face several challenges in Venezuela oil investment, primarily related to political instability and security concerns for their employees. Additionally, the aging infrastructure and the need for specialized refineries to process Venezuela’s heavy crude oil complicate investment decisions. Experts suggest significant financial commitments are necessary to revive Venezuela’s oil production effectively.

How does Trump’s administration impact US oil companies’ decisions on Venezuela oil investment?

Trump’s administration has actively encouraged US oil companies to invest in Venezuela, emphasizing long-term access to its oil reserves. However, the willingness of these companies to engage in Venezuela oil investment depends on their assessment of risks, including political stability, security for operations, and the economic viability of heavy crude oil production.

What is the outlook for heavy crude oil from Venezuela regarding US oil investments?

The outlook for heavy crude oil from Venezuela regarding US oil investments is mixed. While Venezuela possesses vast reserves, the global trend is shifting away from heavy crude due to declining demand for gasoline and diesel. Consequently, US oil companies may be hesitant to invest heavily in Venezuelan heavy crude without a sustainable and profitable extraction plan.

What investment is needed to restore oil production in Venezuela, according to experts?

Experts estimate that around $180 billion in investments will be needed to restore Venezuela’s oil production to its peak level of three million barrels per day by 2040. This substantial investment poses a significant barrier for US oil companies considering entry into the Venezuelan oil market.

Will US government support affect private investments in Venezuela oil?

While the US government has shown intent to support oil sector engagement in Venezuela by U.S. companies, the actual impact on private investments will depend on how secure and stable the operational environment becomes. Companies will likely weigh government assurances against existing risks before committing to Venezuela oil investments.

What potential strategies could smaller US oil companies employ in Venezuela?

Smaller US oil companies might adopt strategies like targeted investments to revamp existing facilities, allowing for increased production without the heavy commitment larger firms face. They could capitalize on repairing infrastructure and operations to boost output in the short term, despite the larger barriers present in the industry.

What role does political stability play in Venezuela oil investments from US firms?

Political stability is crucial for US firms considering Venezuela oil investments. The lack of a stable political landscape raises concerns over security and the potential for conflict, which could jeopardize operations and lead to financial losses. Thus, a predictable political environment is essential for substantial investment from US oil companies.

| Key Points |

|---|

| The US aims to secure long-term access to Venezuelan oil despite uncertainties in investment from corporations. |

| President Trump urges oil companies to invest quickly, though enthusiasm in the industry is low. |

| Experts highlight the challenges of investing in Venezuela due to the country’s heavy crude oil and outdated facilities. |

| Venezuela is estimated to hold over 300 billion barrels of crude oil, but accurate numbers are disputed. |

| The US may need to invest about $180 billion by 2040 to revive production to levels from the 1990s. |

| Political stability and security for local employees are significant concerns for any US investment in Venezuela. |

| Trump suggests subsidizing oil companies to boost their interest in Venezuelan crude. |

Summary

Venezuela oil investment continues to be a topic of great interest amid the complexities of the nation’s political and economic landscape. As President Trump urges American oil companies to engage with Venezuela’s substantial oil reserves, significant doubts persist about the feasibility and profitability of such ventures. The combination of heavy crude oil characteristics, outdated infrastructure, and the need for political stability presents considerable barriers. While there is potential for investment, the uncertainty surrounding these factors may deter many corporations from entering the market.