The recently released US banks earnings report has left analysts and investors buzzing with mixed sentiments. After a series of strong financial results from major institutions like JPMorgan Chase and Bank of America, expectations were high for the latest quarterly reports. However, as key players such as Wells Fargo and Citigroup unveiled their earnings, the results were not as optimistic as anticipated. Despite some revenue growth driven by consumer spending and investment banking, many banks faced notable challenges that hindered their overall performance. As the market reacts, all eyes remain on the implications of these financial results in a shifting economic landscape.

Analyzing the latest disclosures from prominent financial institutions, the recent quarterly earnings from US banks have sparked discussions about their health and future prospects. With major entities like JPMorgan Chase, Bank of America, and Wells Fargo detailing their financial standings, stakeholders are keen to decode the implications of these figures. The competitive landscape of American banks reveals both opportunities and challenges, leading to a nuanced reflection on their operational success and strategies. Observers are particularly interested in how these results compare to past performance, especially given the volatile economic conditions impacting consumer behavior and lending practices. Amidst these earnings announcements, understanding each bank’s strategic response becomes crucial for predicting future market trends.

Overview of US Banks Earnings Reports

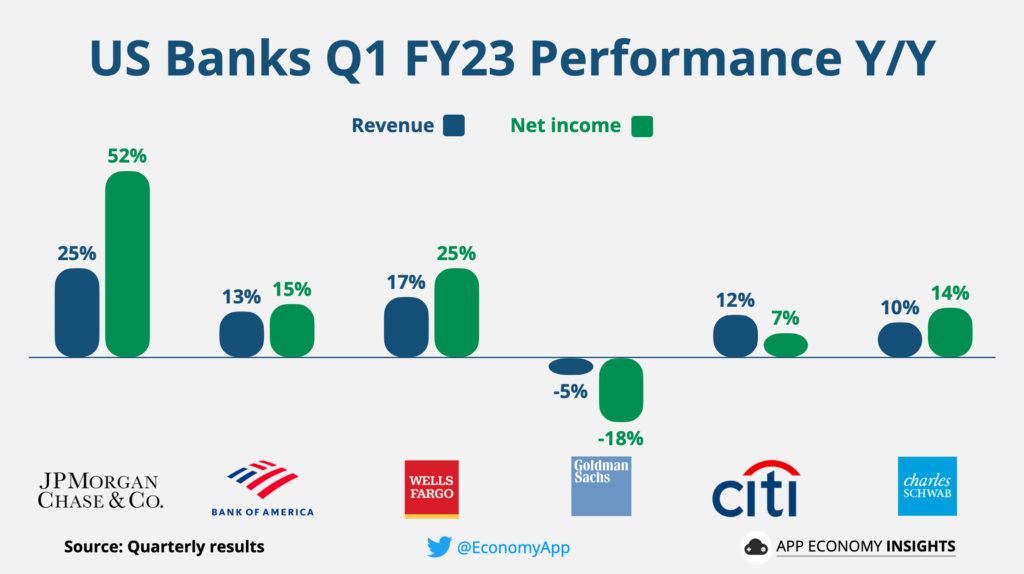

The current earnings reports from US banks present a mixed picture as investors wrestle with market volatility and shifting economic conditions. Major institutions like JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup have recently disclosed their financial figures, highlighting both strong revenue growth and emerging risks that have raised concerns among analysts and shareholders alike. Traditionally, these large banks set the stage for the earnings season, serving as bellwethers for the broader financial market, and their performance often shapes investor sentiment for the weeks that follow.

With the ongoing fluctuations in trading volumes and investment banking revenues, the earnings reports show that while banks have capitalized on existing economic conditions, the outlook is clouded by rising costs and political uncertainty. As profitable as 2025 seemed for these financial giants, the realities of unforeseen expenses and operational risks have tempered expectations, leaving many analysts questioning the sustainability of this growth as we move further into 2026.

Key Financial Results from Major Banks

When analyzing the US banks’ financial results, several key players stand out. JPMorgan Chase, despite facing acquisition-related costs, reported healthy profits driven by robust trading activities. Conversely, Bank of America’s earnings, while impressive, fell short of market expectations, leading to a muted response from investors. Wells Fargo’s results showcased the impact of higher personnel costs, which have raised concerns about overall operational efficiency. Citigroup’s decision to divest its Russian operations for a substantial write-off adds another layer of complexity to its financial narrative.

These results underline the nuanced performance of banks amidst an evolving economic landscape. The reported earnings demonstrate significant revenue growth in traditional areas such as investment banking and trading, but they also highlight the challenges these institutions face, such as rising operational costs and strategic business decisions that may not yield immediate benefits. The collective performance of these banks offers a broader insight into the US financial sector’s resilience and response to both domestic and international market pressures.

Challenges and Opportunities in the Banking Sector

The latest reports also shed light on the persistent challenges faced by the banking sector, such as regulatory pressures, rising costs, and the looming risk of interest rate caps proposed by political leaders. The suggestion to limit credit card interest rates to 10% could significantly affect profit margins for banks, particularly those relying on credit products. Financial experts have indicated that such a move would not only influence lending strategies by banks but could also drive a reevaluation of risk profiles for credit applicants.

In addition to political challenges, the banks must navigate their operational hurdles, such as rising labor costs and the need for efficiency improvements. Institutions like Wells Fargo are working to manage these rising expenses strategically. The potential for a reevaluation of lending practices due to proposed changes in interest rate policies could create opportunities for banks to innovate their product offerings and enhance customer engagement. As the sector adapts to these challenges, there remains a prospect for financial institutions to strengthen their market positions.

Market Reactions to Earnings Reports

Market reactions to the latest earnings reports from US banks have been notably mixed, reflecting a complex interplay of investor sentiment and economic indicators. While some banks, such as JPMorgan Chase, saw temporary gains in their stock prices following their announcements, others have encountered selling pressure, as investors weigh the implications of higher costs and uncertainty in the broader economic landscape. The disappointing results from competitors like Bank of America and Wells Fargo contributed to a broader market pullback, highlighting the cautious nature of investors following the reports.

This divergence in market reactions signals not only the critical importance of earnings figures but also the heightened sensitivity of investors to economic signals and performance benchmarks. With analysts forecasting potential volatility in the coming quarters, the banking sector could experience increased scrutiny, making it vital for these institutions to demonstrate clear strategy and effective risk management moving forward.

Analyst Insights on Future Banking Performance

Analysts and financial experts are closely monitoring the performance of US banks as the economic landscape evolves into 2026. While the recent earnings reports indicate that institutions like JPMorgan Chase and Citigroup have weathered certain challenges, concerns remain about how effectively these banks can adapt to potential regulatory changes related to interest rates. Experts suggest that while current results may be satisfactory, the sustainability of these financial institutions will depend on their strategic responses to emerging political and economic risks.

Moreover, the outlook also hinges on consumer behavior, particularly in terms of spending and credit utilization. If banks can leverage their financial results to innovate their offerings while managing operational costs, they may position themselves favorably in a competitive market. Experts like Jake Johnston stress the importance of strategic planning as banks navigate these dynamics, suggesting that success will rely heavily on adaptability in pricing, credit offerings, and overall risk management strategies.

Impact of Proposed Interest Rate Limits

The implications of proposed interest rate limits on credit cards have raised significant concerns among financiers and banking executives. Should legislation cap interest rates at 10%, many banks might find their traditional revenue streams significantly challenged. This regulatory approach could force banks to reassess their lending frameworks and potentially tighten credit availability to mitigate risks associated with reduced profit margins on credit products.

Banking professionals argue that the move could have far-reaching effects not only on consumers but also on financial institutions’ overall profitability. Investors are particularly wary of any shifts that might limit banks’ ability to generate revenue through normal credit card operations. Steering through this uncertainty will require banks to devise innovative strategies to retain profitability while serving their customers adequately, ensuring a balance between regulatory compliance and business performance.

Earnings Season: Broader Economic Implications

The current earnings season offers valuable insights into the broader economic implications for the US banking sector and beyond. As major banks report varying degrees of profitability, their performances serve as indicators for investors regarding the financial health of the economy. The earnings reports reflect ongoing trends of revenue growth amid rising costs, and they highlight the distinct challenges that each institution faces in adapting to an ever-changing economic environment.

Additionally, the performance of these banks can influence consumer confidence and spending behaviors across multiple sectors. Should economic conditions remain favorable, the results may encourage increased investment and lending. Conversely, a downturn in banking profitability could signal caution among consumers and businesses, ultimately impacting spending and growth across the market. Therefore, these earnings reports not only serve as a reflection of the financial sector’s health but also provide foresight into potential shifts in consumer and economic dynamics.

Comparative Analysis: US vs. International Banks

Comparative analyses between US banks and their international counterparts reveal notable differences in performance trajectories and operational strategies. While US banks, such as JPMorgan Chase and Citigroup, are grappling with domestic challenges and regulatory pressures, international banks often navigate varied economic environments, leading to diversified risk profiles. This comparative performance sheds light on varying growth strategies and adaptability in different market conditions.

International institutions may also face unique regulatory frameworks and market demands that shape their financial results. This juxtaposition enables investors to consider the broader financial landscape and potential investment opportunities. Understanding these dynamics can inform investment decisions and strategy formulation as stakeholders evaluate risk and reward in the global banking sector.

Long-Term Outlook for the Banking Sector

The long-term outlook for the banking sector remains a topic of careful consideration among investors and financial analysts. With recent earnings reports revealing both strengths and weaknesses, the path forward for US banks will likely depend on how effectively these institutions address operational challenges while adapting to evolving regulatory landscapes. Analysts predict that ongoing economic fluctuations and geopolitical uncertainties will continue to influence the performance of these financial institutions.

Moreover, banks that prioritize digital transformation and innovation may have a competitive edge in appealing to tech-savvy consumers. As the banking landscape evolves, institutions will need to focus on integrating technology to enhance customer experiences while optimizing their operational efficiency. The agility of banks to navigate these changes will ultimately define their success and resilience in the years to come.

Frequently Asked Questions

What were the key takeaways from the recent US banks earnings report for JPMorgan Chase?

The latest JPMorgan Chase earnings report indicates strong revenue growth driven by a flourishing trading business and successful investment banking activities. However, the report also highlighted challenges, including acquisition costs related to Apple’s credit card business, which have impacted overall profits.

How did Bank of America perform in its earnings report compared to previous quarters?

In its latest earnings report, Bank of America showed solid financial results with notable revenue growth. Despite these positives, the market reacted negatively, indicating investor concerns about overall performance amid rising costs and increasing economic risks.

What challenges were highlighted in the Wells Fargo report regarding their recent financial results?

The Wells Fargo report noted higher personnel costs that affected profitability. While the bank experienced revenue growth, these increasing operational expenses raised concerns among investors, contributing to a lukewarm market response.

How did Citigroup manage its financial results amidst economic challenges?

Citigroup’s recent financial results reflected significant challenges, particularly its complete divestiture from Russia, which led to a $1.2 billion write-off. Despite facing this setback, the bank’s earnings report included some strengths from trading and investment banking activities.

What impact could interest rate proposals have on the financial results of US banks?

Proposed interest rate caps, particularly for credit card lending at ten percent, could significantly affect US banks’ profitability. If implemented, such regulations may force banks to tighten lending practices, which could result in lower earnings in future reports.

| Key Point | Details |

|---|---|

| Market Performance | Recent earnings from major US banks have disappointed investors despite revenue growth. |

| Major Banks Involved | JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup are the key players, with investment banks like Morgan Stanley and Goldman Sachs to report soon. |

| Revenue Growth Factors | Profits driven by a flourishing trading business, rising investment banking activity, and strong consumer spending. |

| Risks and Challenges | Increased costs from acquisitions, divestitures, and rising personnel costs have affected profitability. |

| Political Impact | Proposed interest rate caps for credit cards may impact banks’ lending profitability. |

| Outlook for 2026 | Mixed outlook due to favorable earnings amid various economic and political risks. |

Summary

The US banks earnings report highlights the current disappointing performance of major banks despite previous revenue growth. While institutions like JPMorgan Chase and Bank of America have seen significant profits from trading and investment banking, investors have reacted negatively due to increasing costs and potential political interference in the form of proposed credit card interest rate caps. This mixed outlook for 2026 reflects broader trends that could affect various sectors as they report their earnings this season.