Understanding the nuances of the basic pension is crucial for anyone planning for retirement in Germany. This individual financial support is designed for those who have dedicated years to work but have earned below the average, potentially affected by various factors including partner income. Notably, a recent ruling by the Federal Social Court has clarified that the income of a spouse can influence an individual’s pension entitlement, presenting a significant aspect for married couples. In contrast, unmarried couples navigating similar financial circumstances do not face such deductions, as they are not legally bound by civil law maintenance obligations. As the discussion surrounding pensions evolves, grasping these intricacies helps individuals better prepare for their future financial security.

The concept of basic pension, which acts as a financial cushioning for long-serving, low-earning workers, brings to light various implications when it intersects with spousal earnings. This retirement benefit, introduced recently, may encounter different eligibility criteria based on a partner’s income, affecting the overall financial landscape for married individuals. In contrast, partners living together without formal marriage can retain their full pension allowance despite a higher income from one party, highlighting a divergence in civil law obligations regarding maintenance and support. As families plan for longevity in their retirement years, understanding these distinctions becomes imperative for effective financial planning. Addressing these aspects ensures that both individuals and couples can navigate their entitlements more effectively.

How Partner Income Influences Basic Pension Benefits

The recent ruling by the Federal Social Court (BSG) has significant implications for couples where one partner earns a high income while the other has a lower earning potential. According to the BSG, when determining eligibility for the basic pension, a spouse’s income is included as taxable income, which can diminish the pension entitlement of the lower-earning partner. This means that individuals who may have worked for decades to secure their financial future could see their benefits negatively impacted if their spouse has a significant earning advantage. It raises crucial questions about fairness and equity in the pension system for married couples compared to their unmarried counterparts.

Conversely, the court has clarified that unmarried couples are not held to the same financial standards. In scenarios where partners are in a non-marital cohabitation, the income of one partner does not factor into the basic pension calculations of the other. This decision underscores the differences in civil law maintenance obligations. While spouses are bound by a legal duty to support one another, unmarried partners do not have this obligation, allowing them to potentially receive the basic pension without their benefits being affected by their partner’s income.

Civil Law Maintenance and Its Impact on Basic Pension Eligibility

The ruling from the Federal Social Court highlights the legal distinctions that exist between married and unmarried couples regarding civil law maintenance. Married couples are legally obligated to support one another financially, especially in cases of elderly care or when one partner has insufficient income to meet their basic needs. This civil law maintenance obligation can create a situation where the higher-income spouse must provide support that impacts the lower-income spouse’s eligibility for benefits like the basic pension. The law assumes that married individuals are more interconnected in their financial well-being, which justifies the inclusion of their combined incomes in pension calculations.

In contrast, this ruling emphasizes that unmarried couples, or those in non-marital cohabitation, have no legal requirement to support each other, thereby allowing each partner more autonomy regarding their financial independence and pension benefits. This presents a stark difference in how each type of relationship is treated under the law, encouraging individuals in unmarried partnerships to take deliberate action in planning for their retirement financial security without fear of their partner’s income affecting their benefits. This difference is crucial as individuals navigate their retirement strategies and the implications associated with their partner’s earning potential.

Understanding Pension Entitlement for Unmarried Couples

Understanding how pension entitlement works is crucial for individuals in unmarried relationships. While the basic pension is designed to provide an additional layer of security for those who may not have earned a significant amount throughout their working life, it is essential for unmarried couples to recognize that their income dynamics will play a different role in their retirement planning. The Federal Social Court’s ruling states that unmarried partners can maintain their entitlement to the basic pension even when their partner has a substantial income, thus diverging from the treatment of married couples. This presents a unique opportunity for unmarried individuals to secure their financial future without the constraints typically associated with marital income.

However, this also means that unmarried partners need to be proactive in their financial planning. They cannot rely on civil law maintenance as a fallback since it does not apply to their relationship dynamic. This encourages unmarried partners to communicate openly about their financial situations, ensuring both parties are working towards a stable financial future. Understanding these intricacies can empower unmarried couples to make sound decisions regarding their pensions and other retirement benefits, giving them a concrete pathway to financial security despite the absence of traditional marital obligations.

The Basic Pension: An Overview for Couples

Introduced in 2021, the basic pension aims to help those who have earned less than average over their working lives achieve a more secure retirement. For couples, understanding how this benefit works and how it interacts with each partner’s income is essential, particularly in light of the Federal Social Court’s recent ruling. The basic pension is designed to provide financial support to those who need it most, but factors such as a higher spouse’s income can significantly affect eligibility. This creates a challenging scenario for individuals who have worked diligently yet still find themselves at the mercy of their partner’s financial situation when seeking pension benefits.

Moreover, the basic pension serves as a reminder of the inequalities that exist within the current pension system. With regulations favoring married couples in specific contexts – particularly concerning income assessment – there is a call for reform to ensure that unmarried couples also receive equitable treatment. The basic pension should act as a safety net for all individuals, aligning more closely with modern family structures, which increasingly include unmarried partnerships.

Navigating Financial Security as a Unmarried Couple

Navigating financial security can be a complex undertaking for unmarried couples. Unlike married couples, their financial obligations toward each other are not reinforced by civil law maintenance, which can complicate aspects of retirement planning. Unmarried partners must face the reality that their income levels do not influence one another’s pension entitlements, which can lead to confusion and a lack of preparedness for retirement. Understanding these norms allows unmarried couples to create tailored financial plans that reflect their unique circumstances and needs.

It’s crucial for unmarried couples to have transparent conversations regarding their financial status, savings goals, and planning for basic pension benefits. Being proactive about retirement means assessing whether additional strategies are necessary to ensure both individuals can retire comfortably without undue reliance on the other’s income situation. Additionally, taking advantage of pension seminars and financial advising tailored for non-marital partnerships can provide beneficial insights and strategies specific to their unique situation.

Frequently Asked Questions

How does partner income affect basic pension entitlement in Germany?

In Germany, the Federal Social Court ruled that the income of a spouse counts against an individual’s basic pension entitlement. If one spouse earns a significant income, it may reduce the basic pension that the other spouse potentially qualifies for, unlike unmarried couples who are not affected by partner income.

What is the Federal Social Court ruling regarding basic pension and civil law maintenance?

The Federal Social Court ruled that in the case of basic pension calculations, the partner’s income is considered for married couples, due to a civil law obligation to support each other. This is not the case for unmarried couples, who do not owe each other maintenance, allowing them to receive the basic pension regardless of their partner’s income.

Can unmarried couples benefit from basic pension regardless of partner income?

Yes, unmarried couples can still qualify for the basic pension without their partner’s income affecting their entitlement. The Federal Social Court clarified that non-marital partners do not have a legal obligation of support, allowing them to maintain their basic pension rights even if their partner earns a higher income.

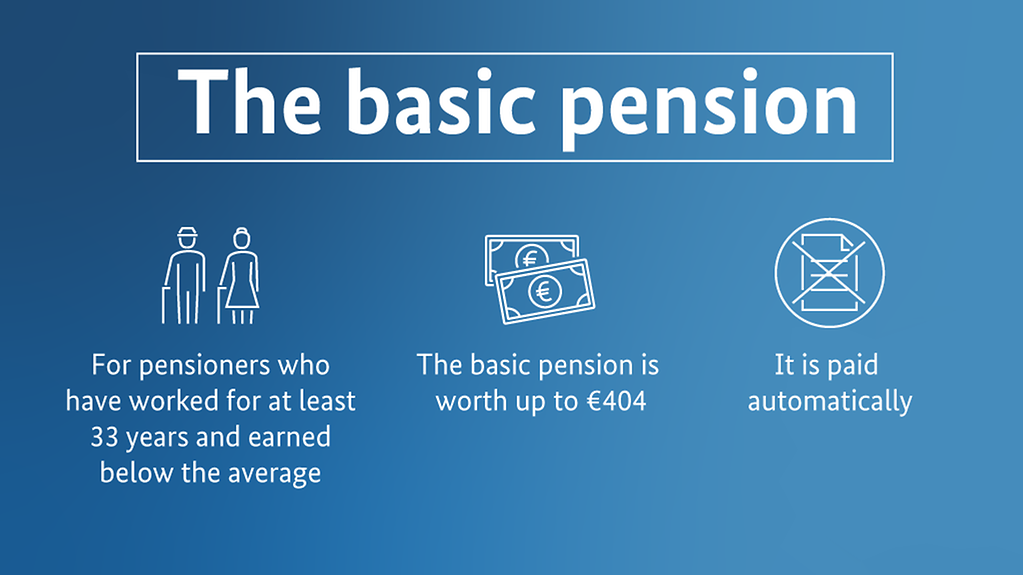

What is the basic pension and who is eligible for it?

The basic pension is a supplement for pensioners in Germany who have worked for a long period and earned below average. It was introduced in 2021 to support those with low income during retirement. Eligibility depends on individual earning history and is influenced by partner income if you are married.

Why does the Federal Social Court treat married couples differently regarding basic pension calculations?

The Federal Social Court differentiates between married couples and unmarried couples in basic pension calculations due to legal obligations. Married couples have a civil law duty to support each other, which means a spouse’s higher income can reduce the other spouse’s basic pension entitlement, unlike in non-marital relationships.

What should unmarried couples know about their rights to basic pension?

Unmarried couples should be aware that their partner’s income will not impact their basic pension entitlement. The ruling by the Federal Social Court ensures that individuals in unmarried cohabitations are treated equally regarding basic pensions, allowing them access to benefits without the influence of partner income.

What are the implications of the Federal Social Court ruling on pension entitlement for couples?

The ruling indicates that married couples’ basic pension entitlement can be adversely affected by higher partner income, while unmarried couples maintain their full pension rights. This creates a disparity that emphasizes the financial responsibilities of marriage compared to non-marital relationships.

| Key Point | Explanation |

|---|---|

| Impact of Spouse’s Income | Spouse’s income is considered when determining entitlement to the basic pension, potentially reducing the amount received. |

| Federal Social Court Ruling | The ruling states that partners in a marriage have their spouse’s income accounted for, while unmarried partners do not. |

| Basic Pension Introduction | The basic pension was introduced in 2021 as a supplement for long-term workers with low earnings. |

| Legal Obligations of Spouses | In Germany, spouses have a legal obligation to support each other financially, impacting pension calculations. |

| Unmarried Partners’ Rights | Unmarried partners are not legally required to support each other, which means higher income does not affect basic pension eligibility. |

Summary

The basic pension serves to support retirees who have contributed to the workforce for many years but have low lifetime earnings. Recent rulings indicate that a spouse’s income can impact the amount of basic pension one receives, underscoring the importance of marital financial obligations. This unequal treatment compared to unmarried partners, who do not share financial responsibilities, highlights significant distinctions within pension eligibility criteria in Germany.