In an unprecedented shift within the corporate landscape, Nvidia has emerged as the most valuable company in the world, surpassing even Apple. As of 2025, Nvidia’s market value has soared to an astonishing $4.6 trillion, thanks in large part to the ongoing AI boom that has captured the attention of investors worldwide. This remarkable achievement underscores Nvidia’s dominant position in tech stock valuation, driven by a staggering 1,330% growth in shares over the last five years. With Nvidia stock growth this year alone exceeding 40%, many analysts view the company’s investment in AI as a pivotal factor for future expansion and profitability. As the tech sector adapts to the rapidly changing world, Nvidia’s ascent emphasizes the pivotal role of artificial intelligence in shaping market dynamics and investment strategies.

The recent triumph of Nvidia in securing its status as the world’s foremost corporation highlights a significant evolution in the technology sector. Known for its innovative graphics processing units, Nvidia is riding the wave of the artificial intelligence revolution that continues to transform businesses and economies alike. This meteoric rise in valuation is a testament to the changing landscape of tech investments, where AI plays a crucial role in driving both stock market performance and investor confidence. As the industry navigates through varying sentiments about tech stock valuations, Nvidia stands at the forefront, demonstrating how strategic investments in cutting-edge technologies can lead to unprecedented financial success. With their sights set on the future, companies are increasingly focusing on advancements in AI to sustain growth and profitability in an ever-competitive market.

Nvidia Surpasses Apple: A New Era of Market Valuation

In December 2025, Nvidia has firmly established itself as the most valuable company globally, surpassing tech giant Apple with a staggering market valuation of $4.6 trillion. This significant shift reflects the explosive growth of Nvidia’s stock, which has seen an impressive 40% increase within the year and an astonishing 1,330% rise over the past five years. Investors have been drawn to Nvidia not just for its semiconductor prowess but also for its strategic position in the burgeoning field of artificial intelligence. As the world leans heavily toward AI-driven solutions, Nvidia’s innovations in graphics processing units (GPUs) place it at the forefront of this technological revolution, further elevating its market value in the eyes of investors.

The comparison of valuations in the tech industry has become heated, as Nvidia’s ascent highlights the contrasting fortunes of leading corporations. With Apple trailing at $4 trillion, the battle for market supremacy underscores the importance of investment in AI technologies. Investors are keenly aware that Nvidia is not only a chip manufacturer but a key player in shaping AI’s future, affirming that its growth is rooted in tech stock valuation paradigms, where companies with groundbreaking technologies command higher market cap allowances.

The implications of Nvidia’s newfound position extend beyond mere stock figures; it signals a benchmark for how investors view the potential of tech stocks in a rapidly evolving market landscape. The AI boom is propelling Nvidia further up the value chain, challenging established norms of market success. As analysts evaluate Nvidia’s business model, it’s evident that the demand for AI-centric capabilities is driving an unparalleled surge in its market presence. The firm not only leads in hardware performance and efficiency, but it also fosters innovation, proving essential for businesses seeking to leverage AI advancements. With such an expansive reach, Nvidia’s durability in maintaining a top market position will depend heavily on sustained innovation and continued investment in AI technologies.

The Impact of the AI Boom on Nvidia’s Financial Growth

The recent AI boom has dramatically reshaped financial landscapes, significantly influencing Nvidia’s stock growth trajectory. The company has emerged as a central beneficiary, capitalizing on surging demand for AI applications across sectors ranging from healthcare to entertainment. Economists anticipate that this trend will persist into the coming years, leading to sustained financial growth for Nvidia. Investors are increasingly optimistic about Nvidia’s ability to deliver returns that match or exceed current valuations, partly driven by a robust pipeline of AI-oriented products and offerings, cementing its status as a leading player in the tech investment arena.

As the AI technology landscape evolves, Nvidia’s financial future appears bright. Analysts suggest that with consistent innovations and expansion into new markets, Nvidia can further exploit the high demand for AI solutions. This positions Nvidia not just as a semiconductor leader but as a critical enabler of various industries’ transitions towards AI integration. The anticipation of continued high investment in AI ensures that Nvidia’s stock remains a topic of interest for both retail and institutional investors, as its current performance hints at a lucrative future aligned with global technological advancements.

However, amid the euphoria of Nvidia’s financial growth, there are concerns regarding sustainability and potential market corrections. Questions abound concerning whether current valuations reflect a genuine growth trajectory or if they are simply inflated bubbles waiting to burst. Skepticism is fueled by historical parallels to major market downturns after periods of rapid growth, prompting investors to weigh the risks carefully. Despite this, Nvidia’s ability to maintain a balanced growth approach and its commitments to ongoing research and development serve to reassure the market about its long-standing potential as a stalwart in the AI and tech domains.

Evaluating Tech Stocks: Are They Overvalued?

The recent surge in tech stock valuations has drawn comparisons to previous market bubbles. Some analysts warn that U.S. tech stocks might be overvalued, recalling the dot-com bubble and the 1929 stock market crash. Prominent asset managers like Blackrock have expressed concerns that the high valuations observed in companies like Nvidia may not be sustainable if economic growth doesn’t keep pace with heightened expectations. With the tech industry portraying impressive earnings potential, there’s an underlying caution among investors, as the landscape is plagued by uncertainty surrounding AI sector profitability and long-term viability in the absence of robust revenue generation.

Amidst the thrilling highs of Nvidia’s stock growth, discussions around valuation metrics have become increasingly pertinent. Experts emphasize the necessity for investors to approach tech stock investments, especially in AI-related ventures, with a thorough understanding of historical trends and market realities. Despite the thrilling prospects presented by Nvidia’s advancements, market caution is vital, as the stakes are high, and a failure to meet growth expectations could lead to significant volatility.

Nevertheless, perspectives on valuations remain diverse among financial analysts. While some caution against potential overvaluation, others argue that the current market environment reflects legitimate technological advancement rather than speculative excess. For instance, Nvidia’s price-to-earnings ratio differs greatly from those seen during the dot-com era, and the company’s sustainable practices, including a strong focus on continued profitability, alleviate some concerns regarding potential market corrections. Thus, while risks in evaluating tech stock valuations exist, Nvidia’s strategic positioning and commitment to innovation may establish it as a more resilient player, navigating through the complexities of investor sentiment effectively.

Is the AI Investment Sustainable for Nvidia?

As Nvidia continues to thrive amidst the AI boom, a crucial question arises: Is the investment in AI sustainable? The electrifying growth in stock value signals investor confidence, yet long-term sustainability hinges on tangible results and the ability to capitalize on innovations within this field. As competition intensifies and new players emerge within the AI sector, Nvidia must persist in evolving its technology offerings to stay ahead. Investors are now closely monitoring Nvidia’s R&D investments and strategic partnerships, recognizing that sustained growth in AI capabilities will be fundamental to maintaining its market leadership.

Moreover, as industries grapple with integrating AI technologies, Nvidia’s alignment with business needs can make or break its future. The success of AI investments is not solely contingent on initial setup costs but also on the ability to provide scalable and transferable solutions across sectors. The focus on achieving practical implementations and real-world applications poses both an opportunity and a challenge for Nvidia. Thus, the company’s continued commitment to innovation and customer-driven solutions will be critical in assessing the long-term viability and returns on AI investments.

Further complicating the landscape is the rate at which AI technology is evolving. Investors are aware that the tech industry is characterized by rapid shifts and unprecedented advancements, demanding agility in product development and market strategies. Nvidia’s commitment to anticipating market needs and preemptively developing solutions will play a vital role in whether its AI investments yield sustainable returns. Sound strategies for navigating competition while capturing emerging AI opportunities will undoubtedly be scrutinized by market players, as they assess Nvidia’s ongoing potential in a sector that remains dynamic and ripe for transformation.

Navigating Investor Sentiments in the AI-Era

In the AI-dominated landscape, understanding investor sentiment is paramount. The transformative effects of technologies can elicit mixed emotions, ranging from excitement over potential gains to anxiety concerning volatility and overvaluation. Nvidia, being at the forefront of the industry, bears the dual responsibility of driving innovation while also addressing these sentiments. The remarkable stock performance can attract new investors eager to capitalize on perceived growth; however, fluctuating perceptions around AI’s profitability can evoke caution among seasoned investors. Balancing these sentiments will be crucial as Nvidia maneuvers through its growth trajectory in a hyper-competitive market.

As we observe the ongoing narrative of Nvidia, it’s important to recognize that the perception of stability or volatility often hinges on externally-driven factors, including technological advances and market fluctuations. Industry stakeholders are thus encouraged to remain vigilant and adaptive with their investment strategies, ensuring they align with the rapid pace and transformative potential offered by the AI sector. Here, Nvidia must continue to communicate its vision and roadmap effectively, reassuring investors of its capacity to navigate risks while maximizing opportunities in this evolving landscape.

Despite the optimistic outlook, irrational exuberance can plague investor sentiment. As such, analysts advocate for caution when interpreting stock movements and market valuations. Understanding the nuances within the AI space will be essential in forming robust expectations regarding Nvidia’s ongoing performance. A collective voice urging tempered enthusiasm against the backdrop of overall market dynamics helps foster a community of informed investors who recognize the importance of realistic growth trajectories, amid the bold advancements Nvidia continues to spearhead.

Key Players in the Tech Industry: The Competitive Landscape

As Nvidia secures its position at the apex of the technology landscape, it faces not just admiration but also fierce competition from other tech giants. With companies like Google, Microsoft, and Amazon forming an impenetrable triangle of innovation, Nvidia can’t afford to rest on its laurels. The competitive pressure from these firms illustrates the relentless nature of tech innovation, where being the leader today doesn’t guarantee the same tomorrow. Thus, Nvidia’s strategic investments in AI-driven solutions establish a pivotal avenue toward maintaining market supremacy amidst an evolving landscape filled with competitive threats.

Nvidia’s differentiation hinges on its ability to deliver high-performance products tailored to meet the growing demands of an AI-centric economy. Competitors are constantly innovating, leading to market saturation in certain tech segments, thereby increasing the stakes for Nvidia’s R&D initiatives. Any lapses in agility or innovation could result in losing critical market share to emerging rivals seeking to seize the burgeoning opportunities that accompany the AI boom.

Moreover, examining the competitive landscape reveals how Nvidia’s victories fuel rival strategies, inciting a ripple effect throughout the industry. Each milestone achieved by Nvidia motivates other firms to accelerate their innovation cycles, leading to advancements that may challenge Nvidia’s current standing. Therefore, staying at the forefront is not merely about technological excellence; it is also about anticipating and effectively responding to counter-strategies from rival companies. Vigilance in crafting strategic partnerships and maintaining industry relevance will ultimately dictate Nvidia’s endurance in this competitive arena.

Future Prospects: Nvidia’s Road Ahead

As we look toward the future, Nvidia has a multitude of pathways to solidify its dominance in the tech sector. The expected demand for AI will continue enabling Nvidia to cater to a broad range of industries, from automotive to healthcare. This technological integration positions Nvidia not only as a chip manufacturer but as a powerhouse for innovation, suggesting promising avenues for growth in the years ahead. As investors keep a keen eye on Nvidia’s pipeline of upcoming projects and potential expansions, the company is poised to navigate the challenging terrain of a rapidly changing market effectively.

Crucially, Nvidia’s ongoing commitment to innovation will drive its future success. The company’s investments in AI and machine learning products signify its dedication to enhancing performance capabilities while tapping into new markets. With an impressive portfolio of intellectual property and development capabilities, Nvidia’s quest to redefine technology is likely to yield dividends for both customers and shareholders. By aligning itself with emerging technological needs and industry trends, Nvidia’s future prospects appear robust, serving as a beacon of growth in the tech investment landscape.

However, challenges remain. Factors such as regulatory scrutiny, market volatility, and global trade dynamics could impact Nvidia’s ambitions. As the company looks to expand its influence in international markets, it must navigate these complexities wisely. A robust risk management framework will be essential in determining how effectively Nvidia can leverage opportunities while mitigating potential setbacks. Ultimately, balancing aggressive growth initiatives with prudent risk balancing will be pivotal in solidifying Nvidia’s status as a leader while maintaining its trajectory of remarkable success.

Frequently Asked Questions

What factors contributed to Nvidia becoming the most valuable company in the world?

Nvidia’s rise to become the most valuable company, with a market value of $4.6 trillion, was primarily driven by the AI boom, which propelled growth in demand for its chips and technologies. The company’s stock saw a remarkable 40% increase within the year, reflecting investor confidence in its innovative capabilities and strategic investments in AI.

How has Nvidia’s stock growth influenced its market value?

Nvidia’s stock growth, showing a staggering 1,330% increase over the past five years and a 40% rise in 2025 alone, has significantly contributed to its market value, which now sits at $4.6 trillion. This growth is largely attributed to the booming demand for AI technologies, making Nvidia a powerhouse in both the tech stock valuation landscape and investor portfolios.

Is the high valuation of Nvidia reflective of a bubble in tech stocks?

While some experts express concerns about the potential for a bubble due to high valuations in tech stocks, others argue that Nvidia’s price-to-earnings ratio of 30 indicates sustainable growth. Economists suggest that if Nvidia continues to innovate and meet earnings expectations, the ongoing AI boom could provide legitimate long-term value rather than signaling a bubble.

What does Nvidia’s investment in AI mean for the tech industry?

Nvidia’s substantial investment in AI positions it as a leader in the tech industry, especially as demand for AI-driven solutions continues to grow. Its advancements not only enhance its stock growth and market value but also push other tech companies to innovate, thereby benefiting the overall tech sector during the ongoing AI boom.

What is the current standing of Nvidia among global technology firms?

As of December 2025, Nvidia ranks as the most valuable company globally, surpassing Apple with a market value of $4.6 trillion. This milestone highlights Nvidia’s leadership in the technology sector, particularly in the context of the burgeoning AI market, where its stock growth and strategic initiatives set a benchmark for other tech firms.

Can Nvidia maintain its status as the most valuable company?

Nvidia’s ability to maintain its position as the most valuable company will depend on its continued innovation and adaptation to market demands, particularly in AI. Given the forecasted growth in the AI sector and Nvidia’s strong market performance, many analysts believe the company still has significant potential for sustained success.

What impact does Nvidia’s success have on investor sentiment in tech stocks?

Nvidia’s record market value and impressive stock growth positively influence investor sentiment in tech stocks, reinforcing the notion that tech investments, particularly in AI, can yield significant returns. This success may encourage further investment in similar companies within the tech space, even amid concerns about high valuations.

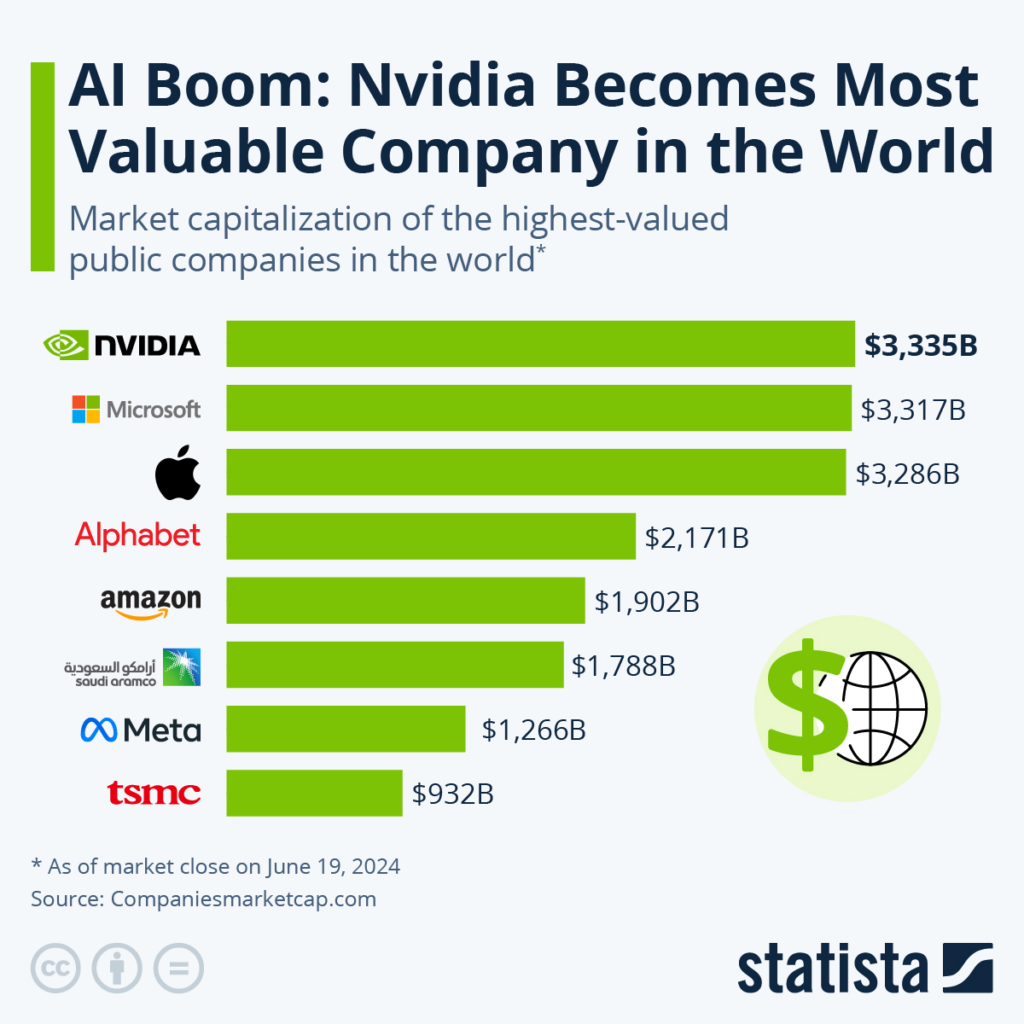

How does Nvidia’s market value compare to other tech giants?

With a market value of $4.6 trillion, Nvidia has overtaken Apple, which stands at $4 trillion, and leads the pack among tech giants. Following Nvidia are Alphabet (Google’s parent company), Microsoft, and Amazon, demonstrating Nvidia’s pivotal role in the current tech landscape and the ongoing AI boom.

What challenges does Nvidia face as it leads the AI-driven market?

As Nvidia leads the AI-driven market, it faces challenges including potential market corrections due to high valuations, competition from other tech companies, and the need to continuously innovate. Investors are also wary of economic conditions that could impact tech stock valuations, making Nvidia’s strategic decisions crucial for its future.

How can investors assess the value of Nvidia’s stock amid the AI boom?

Investors can assess the value of Nvidia’s stock amid the AI boom by monitoring its earnings reports, analyzing market trends, and evaluating the company’s continued investments in technology and innovation. Understanding its price-to-earnings ratio in comparison to historical benchmarks will also provide insights into Nvidia’s long-term viability in the rapidly evolving tech landscape.

| Key Point | Details |

|---|---|

| Nvidia’s Market Value | As of December 30, 2025, Nvidia is valued at $4.6 trillion, surpassing Apple at $4 trillion. |

| Stock Performance | Nvidia’s stock increased by 40% in 2025 and has surged by 1,330% over the past five years. |

| Impact of AI Boom | Nvidia benefits significantly from the global AI boom, with ongoing trends expected to continue into 2026. |

| Investor Concerns | Concerns about a potential market bubble and whether extensive investments will yield returns persist among investors. |

| Valuation Comparisons | Current valuations, with Nvidia’s P/E ratio at 30, are less alarming than during previous bubbles when ratios were much higher. |

| Future Outlook | Analysts predict continued growth in the tech sector, particularly for companies like Nvidia, fueled by high demand for graphics processors. |

| Top Companies | Nvidia leads the world ranking, followed by Alphabet (3rd), Microsoft, and Amazon, while ASML ranks 24th in Europe. |

Summary

Nvidia has emerged as the most valuable company in the world, ushering a new era in the technology sector as of December 2025. This significant achievement highlights Nvidia’s leading role in the AI revolution and underlines the company’s impressive market valuation of $4.6 trillion. With its stock performance soaring and strong demand for innovative graphic processors, Nvidia’s position at the forefront of the tech industry sets a promising outlook for the future, despite concerns about market bubbles and investment sustainability. Ultimately, Nvidia’s rise encapsulates the dynamic shift in market value towards companies harnessing technology and AI, solidifying its status as the most valuable company globally.