The gold price has surged dramatically, reaching an extraordinary record high of over 4,420 dollars as of December 22, 2025. This remarkable increase highlights not only the continuing appeal of gold as a safe haven for investors amid geopolitical tensions but also underscores broader economic factors influencing the gold market. With a staggering annual uptick of nearly 70 percent, the current gold price trend represents the strongest performance since 1979, further emphasizing the importance of monitoring gold price history and developments. Investors are increasingly gravitating towards gold, viewing it as a strategic investment option during times of uncertainty, with many analysts offering gold price forecasts that predict continued demand. As the market evolves, understanding gold market trends will be essential for those considering an investment in gold, particularly in these turbulent times.

The value of the precious metal has seen a remarkable ascent, peaking recently at over 4,420 dollars per ounce, a milestone that underscores the ongoing volatility in financial markets. As global uncertainties persist, this surge in the metal’s worth reflects its status as a reliable asset for safeguarding wealth, often described as a safe haven during economic turmoil. With such significant movements, tracking historical trends related to the metal’s price becomes crucial for investors aiming to anticipate future fluctuations in the market. Analysts are keenly observing the dynamics surrounding gold investment behaviors, especially as central bank demand plays a critical role in propelling prices higher. Consequently, staying informed about advancements in the gold valuation landscape will be vital for anyone involved in trading or investing in gold.

Understanding the Current Gold Price Surge

The recent surge in gold prices to a staggering 4,420 dollars has captured the attention of investors and analysts alike. This unprecedented increase has been largely driven by a combination of geopolitical tensions and economic instability, which have pushed many to seek refuge in safe-haven assets. The rising demand for gold is a clear indicator of investor sentiment leaning towards security amid uncertainty, making it a focal point for those interested in gold price today.

Historically, gold has always been viewed as a reliable store of value, especially during times of crisis. The current climb in gold prices not only signifies the strong investment in gold as a safeguard against inflation but also reflects broader trends in global markets. With an annual increase of nearly 70 percent, this trend is indicative of a strong demand and a potential shift in market behavior, setting the stage for further developments in the gold market.

Gold Price History: An Insight into Its Trends

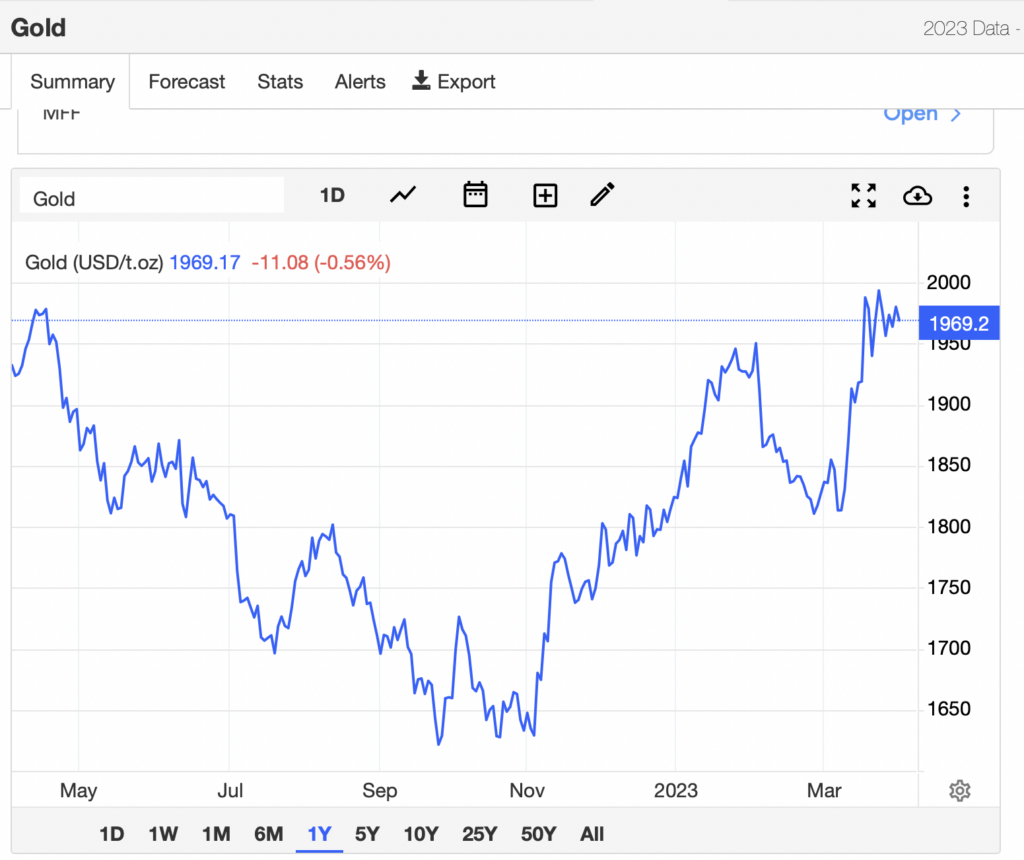

To better understand the implications of the current gold price, we must take a stroll down memory lane. Gold prices have fluctuated through the decades, responding to wars, economic policies, and market trends. However, the price trajectory we’ve seen in recent years highlights a growing trend of instability which seems to correlate with global politics. The history of gold price fluctuations offers valuable insights for investors who analyze current data to forecast future performance.

In this context, the historical prices have demonstrated that while gold might face short-term volatility, the long-term outlook remains bullish. As crises unfold, whether they’re economic downturns or political upheavals, gold traditionally emerges as a leading asset for investment, as evidenced by the recent record highs. This persistent pattern offers investors not just hindsight but also foresight into the stability and reliability of gold as an asset class.

Gold Price Forecast: Where Is It Headed?

As we look towards the future, the gold price forecast remains a hot topic of discussion among market analysts. With current patterns suggesting that geopolitical issues and economic uncertainties are unlikely to dissipate quickly, experts predict that gold prices could maintain their elevated levels. Factors such as falling interest rate expectations, a weaker U.S. dollar, and increased demand from central banks all contribute to a robust outlook for the precious metal.

However, it is crucial to note that fluctuations may still occur, influenced by policy changes and economic growth trajectories. The resonance of current tariffs and any potential escalation thereof could impact gold prices dramatically, leading to sudden shifts in market dynamics. As such, investors must stay informed and adaptive, balancing optimism about gold’s forecast with a prudent awareness of the external factors at play.

The Role of Central Banks in Gold Investment

Central banks play a pivotal role in shaping the gold market, especially as demand from these institutions has surged over the past year. With central banks contributing over 20 percent of global gold demand in 2024 alone, their actions significantly affect gold price movements. The strategy of accumulating gold reserves is often seen as a protective measure against economic downturns, highlighting the importance of gold in global monetary policy.

Furthermore, as central banks continue to build their gold holdings, this trend not only supports current gold prices but also enhances market confidence in gold as a foundational asset. The ongoing accumulation by these banks is a strong indicator of their belief in gold’s long-term value potential, reinforcing its position as a secure investment in uncertain times.

Geopolitical Tensions and Gold Prices

Geopolitical tensions have a profound impact on gold prices, often leading to marked increases as investors shift their focus to safe-haven assets. Events such as conflicts, sanctions, or significant political changes usually generate a flight to quality, where gold emerges as a preferred investment. As current geopolitical landscapes change and tensions heighten, the corresponding gold price reactions are both immediate and pronounced.

The market’s perception that gold serves as a hedge against such uncertainties has led to a growing base of investments in the commodity. Investors often track geopolitical developments closely, aware that any escalation can lead to disproportionate reactions in gold prices. This pattern has been seen time and again in the past, solidifying gold’s role as a bulwark in portfolios against political risk.

Investment Strategies for Gold in the Modern Market

Navigating the modern gold market requires savvy investment strategies that consider not only market trends but also broader economic indicators. With the gold price today reaching historical highs, investors must analyze the market intricacies to time their investments effectively. Diversification remains a key strategy, as allocating a portion of an investment portfolio to gold can hedge against inflation and currency risk.

Moreover, being aware of global market trends and how they influence the gold price forecast is crucial. Potential investors should also consider factors like interest rates, currency strength, and geopolitical climates. By employing a mix of traditional investing tactics alongside contemporary analysis, investors can optimize their approaches to capitalize on gold’s standout performance in the asset class.

The Market Trends Influencing Gold Prices Today

The gold market is influenced by various trends that affect its price trajectory, and understanding these is essential for any investor. Investors today are more inclined to monitor market signals such as inflation rates, currency fluctuations, and geopolitical events that can sway the gold price dramatically. Recent trends have shown a correlation between economic instability and increased interest in gold, leading to its record highs seen recently.

Additionally, the evolution of market psychology plays a crucial part in shaping gold prices. As sentiment shifts towards uncertainty, demand for gold as a safe haven increases, reinforcing price gains. Thus, staying updated on these market trends not only provides clarity on the current gold price but also aids in making informed investment decisions based on evolving market conditions.

Tariffs and Their Impact on Gold Prices

Tariffs serve as a significant factor impacting gold prices, with their effects seen in both immediate and long-term market responses. As the global economic landscape fluctuates due to tariffs, particularly in major economies, the repercussions can ripple through the gold market, influencing prices. If tensions or trade wars escalate, investors often flee to gold as protection against market volatility, leading to price spikes.

Conversely, any resolution or easing of tariff tensions might contribute to stabilizing the markets, which could pressure gold prices downward. The balance between these dynamics indicates that investors must remain vigilant about trade policies and their potential impacts on investment in gold. In essence, tariffs are not just economic policies, but instrumental elements that shape the relative strength of gold in portfolios.

Historical Trends of Gold Prices: Lessons Learned

Studying the history of gold prices reveals critical lessons for investors today. For decades, gold has retained its value even during economic downturns, proving itself as a dependable asset. Historical trends often highlight moments where gold prices skyrocketed during periods of political instability or economic crises, demonstrating its role as a safe haven investment.

Investors can use this historical perspective to inform their future strategies. By recognizing periods when gold prices surged due to specific catalysts—such as major geopolitical events or significant policy changes—investors can better position themselves to capitalize on similar circumstances today. The past serves as a guide, suggesting that in uncertainty lies opportunity.

The Future of Gold Investment: What Lies Ahead?

Looking ahead, the future of gold investments appears promising, particularly given current global economic indicators. Expectations of continued geopolitical uncertainty and fluctuating interest rates may suggest that gold will remain a vital part of investment strategies. With central banks continuing to bolster their reserves and investor interest surging, the potential for high gold prices seems sustained.

However, it’s important to remain aware of market volatility and the factors that influence gold prices, as the landscape is always shifting. Investors should stay informed and adaptive, aligning their strategies with contemporary market conditions while maintaining a long-term perspective on the value of gold in their portfolios.

Frequently Asked Questions

What is the current gold price today?

As of December 22, 2025, the gold price has reached an all-time high of 4,420 dollars per troy ounce, marking significant growth in the gold market today.

How has the gold price history influenced today’s market?

The gold price history shows significant fluctuations, most notably the recent surge to over 4,420 dollars in December 2025, following a rapid increase from 4,380 dollars in October 2025, reflecting ongoing economic uncertainties.

What is the gold price forecast for the upcoming months?

Experts forecast that the gold price may remain high due to ongoing geopolitical tensions and strong demand from central banks, although fluctuations are possible as economic policies evolve.

What are the benefits of investment in gold during price fluctuations?

Investment in gold is considered a safe haven, especially during times of uncertainty, as evidenced by the recent increase in gold price to over 4,420 dollars, providing stability and protection for investors.

What are the current gold market trends affecting gold price?

Current gold market trends indicate rising prices due to geopolitical uncertainties, central bank demand, and a weaker dollar, with recent highs reflecting these factors in the gold price.

| Date | Gold Price | Key Drivers | Market Influences | Future Outlook |

|---|---|---|---|---|

| December 22, 2025 | $4,420 | Geopolitical uncertainties, economic instability, demand for safe haven assets | Central bank demand, real interest rates, dollar weakness | High gold prices expected due to falling interest rate expectations and strong central bank demand, but potential fluctuations possible. |

Summary

The gold price has recently reached a new record high, reflecting significant demand and economic factors. As of December 22, 2025, the gold price soared to $4,420 per troy ounce, marking an almost 70 percent annual increase. This uptick can be attributed to a combination of geopolitical tensions, economic uncertainties, and a robust interest in gold as a safe haven during turbulent times. The demand from central banks and changing market conditions continues to support the upward trend in gold prices, indicating that they may remain elevated despite potential volatility.