Recent US job data has become a focal point for anxious investors, creating ripples across financial markets. The mixed US economic data reveals a nuanced picture of the labor market, with a surprising uptick in the unemployment rate to 4.6%, despite more job creation than anticipated in November. This paradox leaves analysts pondering the effects on inflation and consumer spending as they assess the broader implications for the economy. Moreover, the performance of global indices, like the DAX, may be influenced by these developments alongside the rise of notable stocks, including Tesla, which has been buoyed by optimism in the tech sector. As Warner Brothers contemplates its strategic options amid acquisition discussions, the overall economic environment remains uncertain yet rife with opportunities.

The latest figures from the American employment landscape have stirred considerable speculation among market participants, prompting discussions about the state of economic health. Observations indicate a conflicting narrative where job growth persists, but accompanied by a rising unemployment figure, hinting at potential weaknesses in the job market. Investors, particularly those tracking indices like the DAX, are keeping a close eye on these developments, as they could inform future monetary policy decisions. Furthermore, pivotal shifts in corporate strategies, such as Warner Brothers’ looming acquisition decisions, are interwoven with the economic indicators stemming from job data and tech sector performance. In this intricate dance of market dynamics, understanding the implications of labor statistics can provide valuable insights into both near-term opportunities and long-term investment strategies.

Mixed US Economic Data Influences Investor Sentiment

The recent release of mixed US economic data has had a palpable impact on investor sentiment. Stock markets, especially in the United States, closed under varied conditions reflecting the contradictory signals from the economy. Observers noted how the Dow Jones and S&P 500 recorded slight declines, while the tech-heavy Nasdaq managed to gain ground. This illustrates the uncertainty currently surrounding the US labor market and general economic performance, contributing to investor apprehension and caution in their trading strategies.

For instance, while new jobs added in November exceeded expectations, the simultaneous rise in the unemployment rate to 4.6 percent raised red flags among investors. Companies are expressing concern over wage stagnation which, contrary to inflation worries, points to an overall hesitance in economic growth. This ongoing fluctuation creates a precarious situation for US stock indexes, and the mixed economic indicators serve as a dual-edged sword for investors who must navigate through the complexities of the current landscape.

Current Status of the US Labor Market

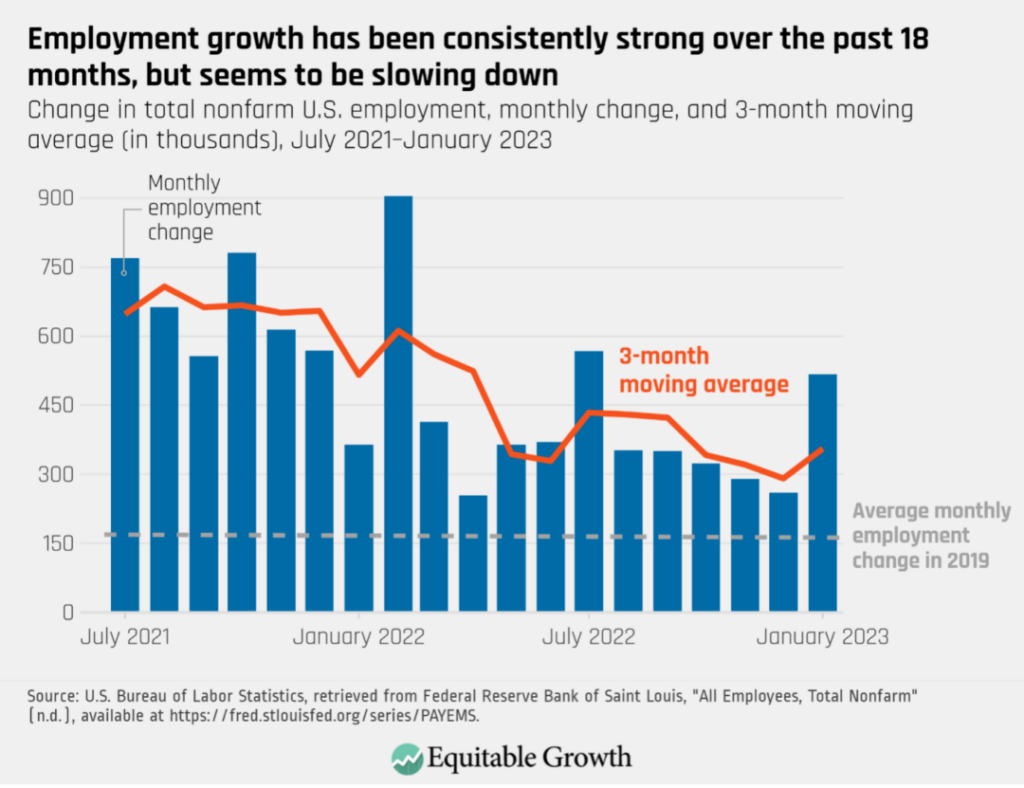

The US labor market is showing signs of volatility, with key indicators suggesting that it remains stagnant. Following the release of labor data, chief economist Brian Jacobsen indicated that although job creation in November surpassed predictions, the labor market has not seen significant progress since April. This stagnation, paired with a rising unemployment rate, has led many analysts to predict a softening in monetary policy from the Federal Reserve. Traders are thus adjusting their expectations regarding potential interest rate cuts in the coming year.

Furthermore, stagnant wage growth poses an additional challenge. Despite the creation of new jobs, workers are not experiencing substantial increases in pay, which could limit consumer spending and economic growth. As these employment and income concerns grow, market watchers are keenly assessing how these trends will influence the future performance of the US economy and its impact on equities in the stock market.

Sector-specific performances are also under scrutiny, as technology stocks like Tesla have shown resilience even amid broader economic uncertainties. The contrasting performances within industries highlight the uneven recovery in the labor market, impacting investor decision-making as they navigate through these challenging conditions.

Impact of DAX Performance on Global Markets

The performance of the DAX index often serves as a barometer for investor confidence in European markets amidst unfolding global economic scenarios. As the DAX opened slightly higher, reflecting a minor gain of 0.1 percent, it highlighted a potential cautious optimism from investors, perhaps influenced by the mixed economic data emerging from the US. This tentative growth indicates that despite surrounding uncertainties, European markets may benefit from investor sentiment that is seeking safe havens amidst fluctuating US indices.

However, this upward movement is precarious, especially when Wall Street has recently displayed a mixed performance. Traders are likely to monitor both US job data and the accompanying retail metrics closely, as any negative shifts could directly influence European market perceptions. Understanding the interconnectedness of stock market performances across regions becomes crucial for investors seeking to capitalize on these fluctuations while mitigating risks.

Tesla Stock Rise Amid Regulatory Challenges

Tesla’s impressive stock rise to record levels reflects growing investor confidence, fueled by optimistic projections regarding the company’s advancements in autonomous driving technologies. Having surged to $491.50, Tesla maintained a remarkable year-to-date performance, eclipsing other stocks in the volatile tech sector. Analysts often cite the company’s strategic focus on innovation as a driving factor behind its notable gains, which placed it firmly within the upper tier of the Nasdaq 100 index.

However, the outlook for Tesla is complicated by regulatory challenges looming over its operations in California. With a potential 30-day sales suspension on the horizon stemming from legal challenges related to its Autopilot feature, investor sentiment could shift dramatically. While regulatory scrutiny of Tesla’s marketing practices raises concerns, the stock’s resilience thus far reflects a strong belief in the brand’s capabilities and growth potential, underscoring the importance of navigating these dual narratives within an evolving market landscape.

Warner Brothers Acquisition Bid: Key Takeaways

The proposed acquisition of Warner Brothers by Paramount Skydance has stirred significant discussions within the entertainment industry. Warner’s recommendation to its shareholders to reject the offer highlights potential strategic pivots that could impact future acquisitions. Notably, Paramount’s bid of $30 per share raises questions about the valuation placed on major entertainment assets, especially when juxtaposed with Netflix’s relatively lower offer. Understanding the dynamics of these negotiations is crucial for investors tracking movements within the media sector.

The presence of notable figures like Jared Kushner in Paramount’s bid adds layers of complexity to the deal, with his recent exit raising flags about the stability of the acquisition proposal. This evolving scenario is reflective of broader trends within the entertainment industry, where companies are seeking strategic mergers to bolster their competitive advantages and content offerings. Investors keen on the crossover between tech and media should keep a close eye on these developments as they could redefine market interactions and valuations across the sector.

Frequently Asked Questions

What does the latest US job data indicate about the labor market?

The latest US job data reflects a mixed labor market with more jobs created than expected in November, yet the unemployment rate rose to 4.6%. This suggests ongoing stagnation in the US labor market since April, contributing to a cautious outlook among investors.

How did the mixed US economic data impact the DAX performance?

The DAX performance was affected by the mixed US economic data, resulting in a small projected gain of 0.1% as traders reacted cautiously to Wall Street’s mixed closures the previous day.

What are the implications of the recent trends in the US labor market for inflation?

Recent trends in the US labor market, including weaker-than-expected wage gains, may lessen inflationary pressures. This could influence the Federal Reserve’s monetary policy decisions, possibly encouraging interest rate cuts.

How is Tesla’s stock related to US economic sentiment?

Tesla’s stock rise to record highs amidst market uncertainty reflects investor optimism over the company’s future, particularly in the context of US job data and broader economic signals which can shape market sentiments.

What should investors know about Warner Brothers’ strategy amid US economic changes?

Investors should note that Warner Brothers Discovery’s plan to reject a bid from Paramount amid shifting US economic conditions could signal their confidence in the company’s resilience and strategy in a mixed market environment.

| Key Point | Details |

|---|---|

| Market Overview | The US economy shows mixed signals, impacting investor confidence and market indices such as the DAX. |

| DAX Performance | DAX ended 0.6% lower at 24,076 points but opened with a slight gain of 0.1%. |

| US Stock Market Trends | Dow Jones down 0.6%, S&P 500 down 0.2%, while Nasdaq rose by 0.2%. |

| Labor Market Data | Job creation exceeded expectations but unemployment increased to 4.6% and wages showed weaker growth. |

| Tesla Performance | Tesla shares hit $491.50 with a year-to-date increase of 21.5%, despite facing a sales suspension in California. |

| Warner Bros Acquisition Bid | Warner Bros. may reject Paramount’s offer of $30 per share, considering a competing offer from Netflix. |

Summary

US Job Data is showing a complex picture that is causing uncertainty among investors. Recently released labor market figures indicate that while job creation has been strong, an unexpected rise in unemployment rates has raised concerns about potential economic stagnation. This mixed data suggests that the labor market is struggling to gain momentum, which could lead to adjustments in monetary policy. Overall, the US Job Data signifies a need for caution among investors as fluctuations in employment effectiveness could impact broader market performance.