Italy’s gold reserves have entered the spotlight amid a contentious push from the Meloni government for legislative changes regarding ownership. Currently managed by the Banca d’Italia, these vast holdings could soon be declared public property, a move that has raised eyebrows within the European Central Bank (ECB). Critics warn that this initiative could lead to significant implications for Eurozone stability, potentially undermining trust in the gold market. Concerns over ECB intervention reflect deeper anxieties about the independence of central banking in Italy and its ripple effects on the European financial landscape. As the debate unfolds, the management of Italy’s gold could redefine the relationship between national assets and governmental authority in Europe.

The discourse surrounding Italy’s precious metal reserves is not just about wealth; it encapsulates the struggle between national sovereignty and central banking authority. The potential reclassification of these reserves as state property under the current Italian administration could alter the dynamics of fiscal responsibility and central bank independence. Amid rising gold prices, the implications of ownership—managed until now by the Banca d’Italia—are magnified by the Meloni government’s interest in reasserting control. As discussions about currency stability and government intervention in the gold market heat up, the situation invites comparisons to other nations’ experiences with national treasures. Understanding this scenario is crucial in recognizing how economic policies shape financial trust across the Eurozone.

Understanding Italy’s Gold Reserves

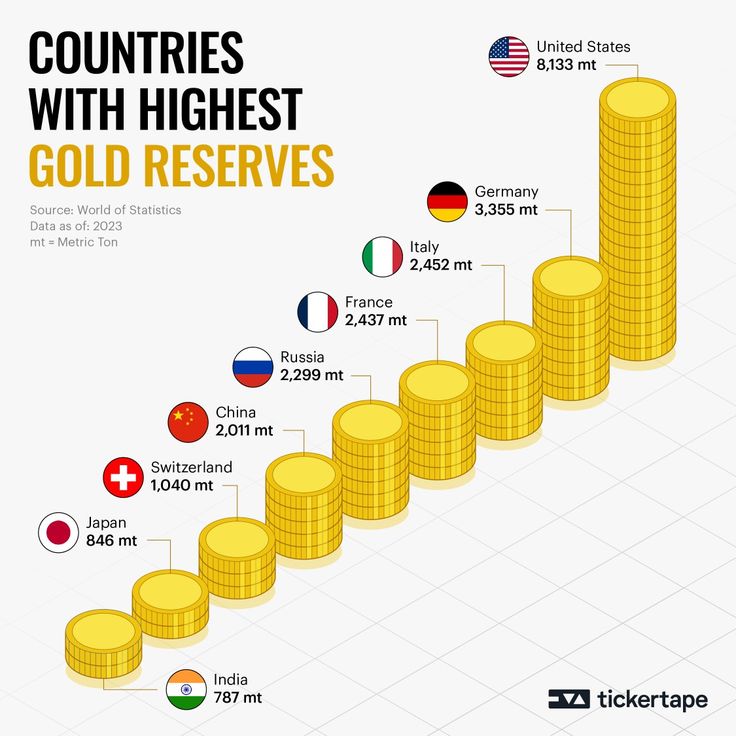

Italy’s gold reserves are among the largest in the world, only surpassed by the United States and Germany. The Banca d’Italia, central to Italy’s financial landscape, holds approximately 2,452 tons of gold. These reserves represent a significant asset for the nation, underpinning its economic stability and serving as a safeguard in times of financial uncertainty. With increasing global demand for precious metals, the status and management of these reserves have become focal points in discussions about national sovereignty and economic policy.

The gold reserves are not merely numbers on a balance sheet; they reflect Italy’s past, particularly its recovery post-World War II when the nation rebuilt its wealth. As the global gold market fluctuates, the value of these reserves can significantly impact Italy’s financial health. Currently valued at around 280 billion euros, Italy’s gold reserves represent nearly 13% of the country’s gross domestic product (GDP). This economic metric highlights Italy’s reliance on these precious assets amidst growing national debt.

The Political Agenda of the Meloni Government

The Meloni government, led by Prime Minister Giorgia Meloni, has sparked significant debate over the ownership and management of Italy’s gold reserves. Proposals to declare these reserves as public property have raised concerns about the potential implications for Eurozone stability. Members of Meloni’s right-wing party, “Fratelli d’Italia,” argue that asserting state ownership reflects the will of the Italian people. However, critics suggest this move is a façade for future government control, potentially leading to troubling interventions in the gold market.

This political shift is alarming for the European Central Bank (ECB), which is tasked with maintaining Eurozone stability. The ECB fears that any alteration in the ownership of Italy’s gold reserves could undermine the institutional independence of the Banca d’Italia, a cornerstone of the European System of Central Banks (ESCB). The ECB has explicitly voiced its concerns, urging the Italian government to reconsider its amendments. Such a precedential move might encourage similar actions by other member states, threatening the overall integrity of the Euro.

The ECB’s Stance on Italian Gold Reserves

The European Central Bank’s involvement in this matter underscores the critical nature of maintaining the independence of national central banks, including the Banca d’Italia. ECB President Christine Lagarde has characterized the situation as a significant concern, emphasizing the need for a clear separation between government and central bank operations to preserve market trust. Political influence over central bank actions, particularly in managing gold reserves, poses risks not only to Italy but to the entire Eurozone.

Moreover, the ECB’s response is rooted in the larger context of financial stability within the Euro area. Political maneuvers affecting central banks can create uncertainty in the market, leading to decreased investor confidence. As Italy contemplates its approach to this reserve, the ECB remains vigilant, stressing that any attempts to appropriate gold reserves must adhere to the mandates set forth by EU treaties, which prioritize central bank independence.

Potential Impact on the Eurozone Stability

The implications of the Meloni government’s proposals are profound, not just for Italy, but for the Eurozone as a whole. If Rome were to gain access to its gold reserves for legislative purposes, it could lead to a domino effect among other member states. The overarching concern is that altering the ownership structure of Italy’s central bank would set a dangerous precedent for the ESCB, which could erode trust in the Euro. This trust is the cornerstone of the Eurozone’s economic framework, where investors require assurance that central banks operate without political motivations.

The potential for government-sanctioned sales of gold to address fiscal deficits raises alarms for financial markets. Investors may perceive this as a systematic risk, leading to heightened volatility in the Euro. History serves as a reminder of the delicate balance central banks must maintain; should Italy’s government alter this equilibrium, the resulting repercussions could be felt across member states, challenging the future stability of the Euro.

The Historical Context of Italy’s Gold Reserves

Italy’s gold reserves hold a significant historical narrative, tracing back to the aftermath of World War II. At that time, the nation faced immense pressure as a result of the Nazi occupation, which had severely depleted its gold holdings. The subsequent investments in gold during the latter half of the 20th century underscore Italy’s determination to rebuild its financial standing and offer resilience against future economic crises.

In understanding this context, one can grasp why the current struggles over gold reserve ownership have stirred up such fierce debate. The ongoing tussle between the Meloni government and the ECB is ultimately a reflection of Italy’s turbulent financial history and its ambitions to safeguard the future. As Italy maneuvers through the complex landscape of national and EU policies, its gold reserves remain a pivotal asset symbolizing both past adversities and future aspirations.

Economic Implications of Selling Gold Reserves

Selling Italy’s gold reserves could provide a temporary financial bandage, but the long-term economic implications raise serious questions. Even if the Meloni government were to liquidate all 2,452 tons of gold and raise around 280 billion euros, this would only cover a fraction of the national debt that exceeds three trillion euros. Critics warn that such a move might merely postpone vital fiscal reforms while undermining future economic stability.

Furthermore, historical context serves as a cautionary tale regarding state gold sales. The UK’s experience in the late 1990s, where the government sold large quantities of gold at historically low prices, often referred to as the “Brown Bottom,” illustrates the potential pitfalls. Once viewed as a misstep, these sales now reflect a missed opportunity, as they forfeited substantial gains that would have been realized if retained. This history is a reminder that while immediate financial relief might seem appealing, it can lead to irreparable long-term consequences.

The Role of Public Perception in Financial Policy

Public perception significantly influences the discourse surrounding Italy’s gold reserves and the proposed governmental actions. Rising sentiments among the Italian populace reflect a desire for increased government accountability, particularly regarding national assets. The framing of gold reserves as ‘public property’ resonates with many citizens who see it as a means to reclaim national wealth that has traditionally been managed by the Banca d’Italia.

However, the government’s narrative must be carefully balanced with the realities of monetary policy. While declaring the gold reserves as public property may appeal to populist sentiments, it risks oversimplifying the complexities of economic governance. It is crucial that the Meloni government effectively communicates its intentions with transparency to foster public trust while avoiding potential conflicts with the ECB’s stipulations for maintaining a stable financial environment.

Future of Italy’s Gold Management Strategies

As discussions surrounding Italy’s gold reserves continue, it is essential for the Meloni government to outline a clear and sustainable plan for future management. Engaging with both the ECB and the broader economic community will be fundamental in determining the path forward. Balancing national interests with European obligations will be a tightrope walk, requiring astute political maneuvering and economic foresight.

With the gold market experiencing fluctuations, Italy must also remain adaptable. Should the government choose to pursue a course of action involving the gold reserves, it will be vital to manage these assets proactively to optimize economic benefits while safeguarding against market volatility. Maintaining a collaborative relationship with the ECB and other member states will be essential to ensure that Italy remains a respected leader within the Eurozone, especially during these economically challenging times.

Frequently Asked Questions

What is the current status of Italy’s gold reserves?

Italy’s gold reserves, managed by the Banca d’Italia, stand at 2,452 tons, making Italy one of the top holders of gold globally. Recent evaluations suggest these reserves are worth approximately 280 billion euros, significantly contributing to Italy’s overall economic stability.

How is the Meloni government proposing to change the ownership of Italy’s gold reserves?

The Meloni government aims to declare Italy’s gold reserves as ‘public property.’ Proposed amendments to the budget law suggest that the gold reserves managed by the Banca d’Italia should belong to the Italian people, a move criticized for potentially undermining the independence of the central bank.

Why is the European Central Bank concerned about Italy’s gold reserves?

The ECB is alarmed by the Italian government’s initiative regarding its gold reserves due to potential risks to the institutional independence of the Banca d’Italia and the stability of the Eurozone. They fear that political intervention in gold reserves could set a troubling precedent affecting all EU member states.

What potential impacts could arise from the government accessing Italy’s gold reserves?

If the Italian government were to access its gold reserves, it could jeopardize trust in the Euro and impact Eurozone stability. Investors might lose confidence in the ECB’s ability to control monetary policy, raising concerns over economic stability across the region.

How could selling Italy’s gold reserves affect the country’s budget deficits?

While selling Italy’s gold reserves could theoretically raise funds, estimates suggest that even if all gold was sold, it would only amount to 280 billion euros, which is a fraction of Italy’s national debt exceeding three trillion euros. Hence, it would not substantially resolve the country’s budget deficits.

What lessons can be learned from other countries regarding gold sales?

Historical examples, such as the UK’s gold sales under Prime Minister Tony Blair, highlight the potential pitfalls of selling gold reserves at low prices. The UK sold gold at an average of $275 per ounce, which is now worth significantly more, underscoring the importance of strategic timing in gold market dealings.

What are the implications of the ongoing debate over Italy’s gold reserves for Eurozone stability?

The implications are profound; if Italy’s parliament enacts measures diminishing the Banca d’Italia’s autonomy over its gold reserves, it could trigger a domino effect among other Eurozone nations, leading to increased political instability and uncertainty about monetary policies across the EU.

How has the valuation of Italy’s gold reserves changed over recent years?

The value of Italy’s gold reserves has soared recently, driven by a significant increase in gold prices, rising over 60% this year alone. The current valuation of around 280 billion euros suggests that gold is an important financial asset for Italy amid economic challenges.

| Key Point | Details |

|---|---|

| Ownership Debate | The Italian government aims to declare gold reserves managed by Banca d’Italia as public property, raising concerns from the ECB. |

| Political Motivations | The ruling party seeks to control gold reserves but critics argue it may enable government sales to alleviate budget deficits. |

| ECB Concerns | The ECB warns that this move could undermine the independence of Banca d’Italia and threaten the euro’s stability. |

| Gold Reserves Value | Italy’s gold reserves are valued at €280 billion, a significant percentage of its GDP, reflecting a surge in gold prices. |

| Historical Context | Past mistakes, such as the UK’s sales of gold at low prices, highlight the risks of selling gold reserves. |

Summary

Italy’s gold reserves are currently at the center of a significant political controversy, as the government seeks to redefine their ownership. This initiative by Prime Minister Giorgia Meloni’s administration not only raises questions about property rights and governmental control but also poses a substantial risk to the institutional independence of the Banca d’Italia, ultimately jeopardizing the stability of the euro. The outcome of this debate could have far-reaching consequences for Italy’s economy and its relationship with the European Central Bank.