The recent discussions surrounding frozen Russian assets have brought significant attention to the financial strategies involving these funds, especially in the context of supporting Ukraine. Key figures, including EU Commission President Ursula von der Leyen and Belgian Minister-President Bart De Wever, are critically analyzing the implications of utilizing the assets held by the Russian central bank. With roughly 185 billion euros managed through Brussels financial institution Euroclear, the stakes involve not just political narratives but also concerns of financial guarantees against potential Russian retaliation. Chancellor Friedrich Merz has traveled to Brussels to persuade De Wever to reconsider his stance, emphasizing the collective responsibility of EU nations in addressing such pressing matters. As debates intensify, the search for a balanced approach that considers both the urgency of aid to Ukraine and the legal ramifications of accessing these frozen funds takes center stage.

The ongoing debate about Russian financial resources that have been immobilized has raised pressing questions not only about ethics but also about international relations. Discussions led by prominent European leaders spotlight the complexities involved in the potential reallocation of these substantial reserves held within institutions like Euroclear in Belgium. Notably, the financial guarantees needed to mitigate risks associated with these funds are paramount, as nations weigh their next steps carefully. The dialogue among EU Commission officials, including Ursula von der Leyen, and national leaders points to a broader concern about how these assets, if released, might affect not only Ukraine but the relationship between Europe and Russia. Each stakeholder acknowledges the delicate balance between providing aid and maintaining diplomatic stability in the region.

The Implications of Frozen Russian Assets

The frozen Russian assets within the EU represent a delicate balance between recovery aid to Ukraine and adherence to international laws. Currently estimated at around 185 billion euros, these funds, primarily managed by Euroclear in Brussels, could potentially provide significant financial support for Ukraine’s rebuilding efforts. However, utilizing these frozen assets raises questions about legality, financial stability, and the principles of international finance. The European Commission, led by Ursula von der Leyen, views the release of these funds as a necessary step, but many member states like Belgium are hesitant, citing concerns about legal repercussions and possible retaliation from Russia.

Moreover, the discussions surrounding these assets involve not only financial guarantees but also ethical considerations about wartime reparations. Chancellor Friedrich Merz and Belgian Prime Minister Bart De Wever are at the forefront of these dialogues, considering the ramifications for both Ukraine and the European Union as a whole. De Wever’s resistance stems from worries that utilizing the Russian central bank funds could leave European entities vulnerable to repercussions, including expropriation of assets within Russia. This precarious situation necessitates a careful approach to ensure that actions taken align with both legal frameworks and moral obligations.

Brussels Talks: Navigating Financial Guarantees

The recent meeting in Brussels between Ursula von der Leyen, Friedrich Merz, and Bart De Wever underscores the complexities involved in negotiating financial guarantees for the use of frozen Russian assets. De Wever has proposed stringent conditions that must be met to protect Belgium’s financial interests and those affected by the potential risks involved in unfreezing these assets. His demands for comprehensive liquidity and multi-tiered risk protection highlight the intricacies of international finance, particularly in times of conflict.

As discussions continue, there is a growing recognition of the need for a collaborative framework among EU nations holding similar frozen assets. Countries like Germany, France, Sweden, and Cyprus also face the dilemma of responding to the urgent needs of Ukraine while safeguarding their own financial systems from potential fallout. The EU Commission must work diligently to present a cohesive strategy that aligns the interests of multiple member states, effectively managing the financial guarantees required to achieve a delicate consensus.

Ursula von der Leyen’s Role in EU Policy Making

Ursula von der Leyen, as President of the European Commission, plays a critical role in shaping EU policy surrounding the use of frozen Russian assets. Her advocacy for utilizing these funds to support Ukraine aligns with broader humanitarian efforts and geopolitical strategy. By bringing together influential leaders like Friedrich Merz and Bart De Wever, she seeks to forge a united front among EU nations, highlighting the importance of collective action in response to Russian aggression.

However, von der Leyen’s task is complicated by the differing views among member states regarding legal implications and financial risks. While she pushes for a resolution that benefits Ukraine, leaders like De Wever remain cautious, prioritizing national interests and the legal frameworks surrounding asset management. This tension illustrates the challenges faced by EU leadership in navigating international crises while maintaining unity and stability within the bloc.

Belgium’s Perspective on Frozen Assets

Belgium, as a key player in the management of frozen Russian assets, has a unique perspective shaped by its financial landscape. With a significant amount of assets managed through Euroclear, the country is understandably cautious about any moves that could jeopardize its economic stability or provoke retaliatory measures from Russia. Prime Minister Bart De Wever’s concerns reflect a broader hesitance among EU member states to move forward without comprehensive protections in place for affected citizens and businesses.

Moreover, the apprehension stems not only from potential economic backlash but also from the broader implications for international finance. Using frozen assets raises ethical questions about reparations and financial justice, particularly in contexts involving conflict. Belgium’s stance highlights the need for dialogue and cooperation among EU nations to craft a strategy that addresses these concerns while simultaneously providing necessary support to Ukraine.

The Debate Surrounding the Use of Frozen Funds

The ongoing debate surrounding the use of frozen Russian assets has divided opinions within the EU. Some stakeholders advocate for releasing these funds to aid Ukraine’s reconstruction, viewing it as a moral imperative in light of the ongoing conflict. However, critics raise valid concerns about the potential legal ramifications and the precedent it could set in international relations. This discourse reveals a significant tension between moral responsibility and the principles of financial legality that govern European institutions.

Furthermore, public sentiment around this issue is polarized, with many citizens expressing reservations regarding the potential fallout from the decisions made by their governments. As the discussions persist, it is essential for policymakers to engage with the public, ensuring that their goals align with broader societal values and expectations. This potential alienation of citizens from governmental decisions could have long-term impacts on trust in EU institutions and their ability to navigate crises effectively.

Legal Frameworks Affecting Financial Decisions

The legal frameworks governing the use of frozen funds are critical in determining the viability of proposals put forth by EU leaders regarding Russian assets. Member states must navigate a complex web of regulations that dictate how such funds can be utilized, especially in light of the ongoing conflict in Ukraine. The conversations led by Ursula von der Leyen, Friedrich Merz, and Bart De Wever highlight the urgent need for a comprehensive understanding of these legal structures, as they seek to address the humanitarian needs presented by the current crisis.

Moreover, any decision to unfreeze or utilize these assets must be accompanied by thorough legal analyses to mitigate the risks of future litigation or retaliation from Russia. This complexity emphasizes the importance of collaboration among legal experts, financial institutions, and policymakers to ensure that any actions taken are sound within the legal context. As these discussions evolve, the outcomes may significantly influence not only the future of EU-Russia relations but also the principles of global financial governance.

International Reactions to Frozen Asset Policies

The policies surrounding the use of frozen Russian assets are closely monitored by international stakeholders, with reactions varying widely across different nations. Countries outside the EU are particularly interested in how the bloc navigates the legal and ethical implications of using these funds. The reactions range from support for Ukraine’s need for reconstruction funds to skepticism about the legality and fairness of utilizing such assets. Leaders from various countries are watching closely to see how the EU’s decisions may set precedents in global finance.

In addition, international reactions help shape the discussion as countries reassess their own positions regarding sanctions and frozen assets. The potential repercussions of these policies extend beyond the EU, potentially impacting diplomatic relations and economic frameworks globally. It is crucial for EU leaders to consider these international perspectives as they strive for solutions that balance humanitarian needs with lawful economic practices.

The Role of Financial Institutions in Asset Management

Financial institutions play a pivotal role in the management of frozen Russian assets, particularly in how these funds can be distributed or utilized legally. Euroclear, as a significant entity managing the bulk of these assets, faces increasing scrutiny as discussions intensify around their use for humanitarian efforts in Ukraine. The decisions made by these institutions have wider implications for international finance and the relationships between nations, as they aim to navigate both regulatory demands and ethical considerations.

The integration of risk management and legal safeguards is paramount for financial institutions during this process. Leaders like Bart De Wever emphasize the importance of financial guarantees to protect the interests of all parties involved. As these organizations adapt to the evolving landscape of international relations and financial law, their strategies will likely influence how other countries view cooperation on similar issues of frozen assets.

Future Outlook for EU-Russian Financial Relations

The future of EU-Russian financial relations is currently under intense scrutiny, especially as the possibility of utilizing frozen Russian assets for Ukraine continues to spark debate. The outcomes of discussions held in Brussels will likely set the tone for future interactions between the EU and Russia, particularly regarding sanctions and asset management. As nations assess the impact of decisions made today, there is a palpable sense of urgency about finding a resolution that not only meets Ukraine’s urgent needs but also carefully considers the geopolitical landscape.

Moreover, the stance taken by Belgian leaders, particularly regarding financial guarantees and legal protections, could influence how other EU member states approach similar issues moving forward. The complexities surrounding these frozen funds are sure to remain a central topic in discussions on EU policy, potentially redefining financial relationships and cooperation standards with Russia in the long run.

Frequently Asked Questions

What is the status of frozen Russian assets in Belgium and the EU?

The frozen Russian assets, particularly those managed by the Brussels financial institution Euroclear, amount to approximately 185 billion euros. The European Commission views these funds as potential financial support for Ukraine, but Belgium, led by Prime Minister Bart De Wever, opposes the plan due to legal and financial risks.

Why is Belgium opposed to using frozen Russian assets for Ukraine?

Belgium’s opposition, as articulated by Prime Minister Bart De Wever, stems from concerns over legal implications and potential retaliatory actions from Russia. He emphasizes the need for financial guarantees and risk protections for Belgian citizens and companies before supporting the use of frozen Russian central bank funds for Ukraine.

How do financial guarantees play into the discussion of frozen Russian assets?

Financial guarantees are a critical component of the debate on frozen Russian assets. Bart De Wever has insisted on strong financial guarantees to cover potential obligations and risks associated with using these funds, ensuring that affected parties have adequate protection.

What role does Ursula von der Leyen play in the discussions about frozen Russian assets?

Ursula von der Leyen, the President of the European Commission, has been actively involved in discussions with Chancellor Friedrich Merz and Prime Minister Bart De Wever to advocate for the use of frozen Russian assets to assist Ukraine. Her participation highlights the EU’s strategic interest in mobilizing these resources.

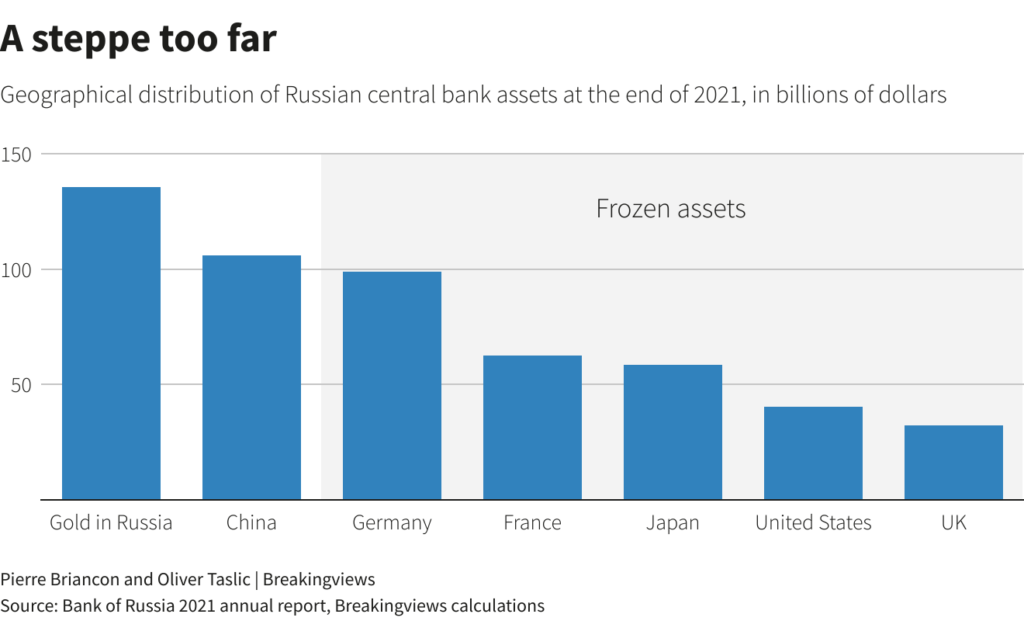

Which other countries have frozen Russian central bank funds alongside Belgium?

In addition to Belgium, several countries, including Germany, France, Sweden, and Cyprus, hold frozen Russian central bank assets. The EU Commission is seeking solidarity among member states regarding the potential use of these funds for Ukraine.

What are the potential international repercussions of using frozen Russian assets?

Using frozen Russian assets could lead to international repercussions, particularly concerning diplomatic relations and potential retaliatory measures from Russia against European individuals and businesses. This concern is central to the legal discourse surrounding the assets as outlined by Belgian officials.

How much is Belgium managing in frozen Russian assets and what are the implications?

Belgium is managing around 185 billion euros in frozen Russian assets through Euroclear. The implications of this amount are significant, as the potential use of these funds for Ukraine is heavily debated, with concerns over the financial stability of institutions and legal accountability being paramount.

What conditions has Prime Minister Bart De Wever set for Belgium’s participation in using frozen Russian assets?

Prime Minister Bart De Wever has outlined three conditions for Belgium to consider supporting the use of frozen Russian assets: pooling all potential risks, ensuring sufficient financial guarantees from the start of the plan, and requiring comprehensive liquidity and risk protection for all affected parties.

| Key Point | Details |

|---|---|

| Frozen Russian Assets | These are the assets of the Russian central bank that have been frozen by the EU. |

| Meeting in Brussels | Ursula von der Leyen, Bart De Wever, and Friedrich Merz met to discuss the frozen assets’ usage for Ukraine. |

| Belgium’s Opposition | Belgium, led by De Wever, opposes the use of frozen assets citing legal and financial risks. |

| Amount of Frozen Assets | Approximately 185 billion euros are managed by Euroclear in Brussels. |

| Conditions for Participation | De Wever outlined three conditions for Belgium’s participation, including risk guarantees and liquidity protection. |

| Potential Retaliation | Belgium fears that utilizing these assets may provoke retaliatory actions from Russia. |

| Diverse Opinions | Public opinion is mixed, with discussions on the legality and ethics of freezing or using these assets. |

Summary

Frozen Russian assets have become a hot topic as discussions continue about their potential use to aid Ukraine. The meetings in Brussels involving key European leaders highlight the complexities and challenges surrounding this issue. While there is significant financial potential in these frozen assets, concerns over legalities, potential retaliation from Russia, and the implications for European financial stability remain paramount. As debates progress, the future of these assets and their impact on the ongoing geopolitical landscape will be closely monitored.