In recent months, the intersection of US tariffs and the automotive industry has taken center stage as trade policies continue to shape market dynamics. The implications of the US tariffs on automobiles, especially from European manufacturers, have been profound, causing significant fluctuations in automotive stocks and investor sentiment. With the recent withdrawal of aggressive tariffs, there is a slight recovery underway that could bolster the automotive industry recovery, offering a glimmer of hope amid challenging times. For major players like Volkswagen, this shift is especially timely, allowing them to manage their cash flow better despite weaker European car sales and ongoing shifts towards electrification. The impact of US tariffs persists, underscoring the need for manufacturers to adapt quickly to maintain profitability and progress in this competitive landscape.

The ongoing discourse surrounding import duties and the automotive sector reveals interconnected challenges and opportunities. As tariffs on automobiles evolve, the movement of automotive stocks reflects investor responses to these economic shifts. The recovery narrative in the automotive sector emphasizes the resilience of companies adapting to external pressures, including tariff changes. Additionally, manufacturers are increasingly focusing on technological advancement and diversification in response to market demands. Amidst fluctuating sales figures and strategic transitions, the situation highlights the complexities facing the automotive market and the crucial role of tariff policies in shaping the industry’s future.

The Impact of US Tariffs on the Automotive Industry

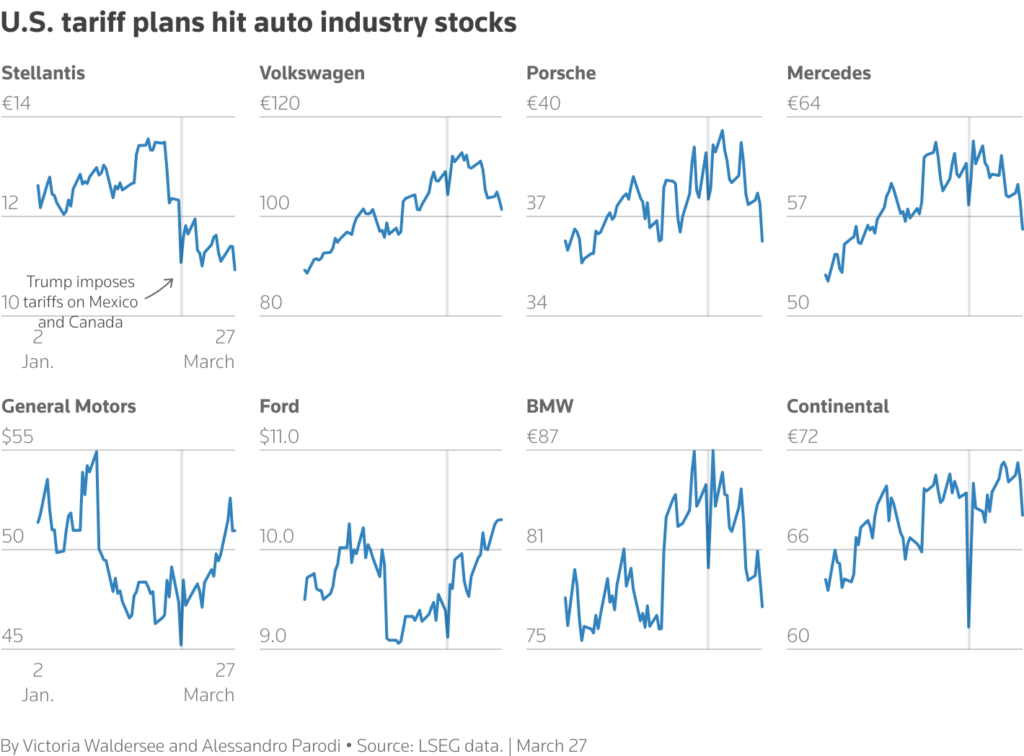

The recent withdrawal of US tariffs has been a pivotal moment for the automotive industry, offering much-needed relief to manufacturers who rely heavily on exports. Previously, the imposition of a blanket import duty of 15 percent on EU cars threatened to strangle growth, placing an immense burden on an already struggling sector. The anticipation of these tariffs had sent the automotive stocks plummeting to lows not experienced since mid-October. However, the easing of these tariffs has sparked a recovery in automotive indices, demonstrating how closely tied the automotive industry’s fate is to tariff policies.

In the wake of potential new tariffs that would have reached as high as 27.5 percent, the positive market response is significant. Automotive stocks have rebounded, with key players like Volkswagen, BMW, and Mercedes seeing increases in their share prices. This recovery not only reflects investor confidence but also underscores the interconnectedness of global markets and the automotive industry’s reliance on international trade. The optimism surrounding the potential for renewed sales across Europe can further enhance the recovery of the automotive sector, particularly with increasing competition in electromobility and software innovations.

Recovery Trends in Automotive Stocks Amid Trade Negotiations

The recent trends in automotive stocks reveal a positive turnaround in the market that is intricately linked to trade negotiations involving the US and EU. As the automotive sector grapples with the dual challenges of shrinking Chinese demand and necessary transformations towards electric vehicles, investors are cautiously optimistic. Reports of Volkswagen posting higher-than-expected cash inflows signal a potential stabilization, prompting a boost in the entire automotive sector’s stock performance. For instance, the spike in Volkswagen’s shares, particularly those rising by 5.5 percent, showcases how investor sentiment can shift dramatically based on external economic factors and tariff negotiations.

In addition to Volkswagen, other major companies in the automotive realm, such as BMW and Mercedes, are experiencing similar recoveries, showcasing resilience against previously imposed tariffs. As automakers navigate the balance between profitability and innovation, continued monitoring of these stock fluctuations is imperative. Market analysts believe that maintaining a healthy dividend payout is critical, as it implies sustained profitability amidst competitive pressures and operational challenges. The recovery of automotive stocks amidst tariff fluctuations and trade discussions is a crucial indicator of the automotive industry’s potential for long-term viability.

Volkswagen’s Performance: A Beacon in the Automotive Industry

Amidst the uncertainties surrounding the automotive industry, Volkswagen has emerged as a standout performer, largely due to its unexpected cash flow and strategic position in the market. Analysts noted that the company managed to secure a significant cash inflow of six billion euros for 2025, outstripping projections and contributing to a surge in investor confidence. This cash reserve is particularly important as manufacturers like Volkswagen pivot towards electrification and sustainable practices, essential for remaining competitive in a rapidly changing market. With these financial strengths, Volkswagen is poised to navigate the challenges posed by tariffs and shifting consumer demands effectively.

Furthermore, Volkswagen’s anticipated performance highlights a positive shift in sentiment regarding the future of the automotive sector. With a focus on innovative practices and a strategic response to past tariff threats, the company exemplifies how resilience can yield robust market performance. The supportive ecosystem provided by reducing dependencies on specific markets, such as China, allows Volkswagen to mitigate risks effectively. As a result, the stock’s strong performance not only benefits Volkswagen but also offers hope to the entire automotive industry, suggesting that recovery is feasible even in the face of mounting pressures.

European Car Sales: Trends in the Wake of Tariff Adjustments

The landscape of European car sales is witnessing transformative shifts as a direct response to recent tariff adjustments imposed by the US. The automotive industry has historically relied on exporting vehicles to the US market, making the relaxation of tariffs a crucial factor in propelling sales forecasts for European manufacturers. With the dawn of more favorable trading conditions, stakeholders anticipate increased consumer demand leading to heightened production levels and enhanced market penetration within the US. As tariffs ease, European car manufacturers are likely to seize the opportunity to bolster their market presence effectively.

In conjunction with the positive market response, German automotive makers are also adjusting their strategies to improve overall sales performance. Companies are investing in cost-cutting programs and innovating within the realms of electromobility and digital advancements, responding to shifting consumer preferences. This proactive approach aims to reclaim the lost market share due to tariff pressures and provide a robust avenue for future growth. As European car sales improve alongside tariff negotiations, the outlook for the automotive industry gains additional momentum, signaling a return to stability and profitability.

Future Prospects: The Automotive Industry’s Adaptation and Growth

The future of the automotive industry hinges on its ability to adapt and respond effectively to a myriad of challenges, including evolving consumer expectations, technological advancements, and international trade uncertainties. The transition toward electric vehicle production is not just a trend but a fundamental shift that requires manufacturers to enhance their operational frameworks and product offerings significantly. Companies that successfully navigate these changes will not only enhance their market position but also contribute to the broader recovery of the automotive industry, particularly in regions heavily impacted by previous tariff policies.

Moreover, the resilience exhibited by top automotive players suggests a landscape ripe for growth. With diversified strategies focusing on profitability and innovation, the industry is heading toward a crucial transformation period. The interconnectedness of automotive stocks and economic indicators underscores the necessity for manufacturers to remain agile and responsive to market dynamics. Analysts predict that as long as major manufacturers continue to post profits and adapt to the changing environment, the automotive industry stands on the precipice of a bright future, buoyed by recent tariff adjustments and increasing consumer interest in sustainable vehicles.

Understanding the Challenges Faced by Automotive Suppliers

While major automotive manufacturers are experiencing improved stock performance and recovery, the plight of automotive suppliers presents a stark contrast. The shift toward electric vehicles and advancements in technology have left many suppliers struggling to adapt, facing significant job cuts and closures. This transformation highlights the vulnerabilities within the supply chains that support the automotive industry, pointing to a need for greater resilience and flexibility among suppliers. As large manufacturers exert cost pressure, smaller component producers risk exacerbating their challenges, prompting urgent calls for industry-wide support.

Industry experts, such as automotive analysts, caution that while manufacturers like Volkswagen and BMW remain profitable, the supply chain’s health is precarious. Many suppliers have been left in crisis, unable to transition as swiftly as their larger counterparts. The emerging trend of critical components being rendered obsolete in the age of electrification adds an additional layer of complexity. Addressing these challenges requires collaborative efforts to ensure that the benefits of recovery extend throughout the entire automotive ecosystem, ultimately stabilizing the market and enabling sustainable growth across manufacturers and suppliers alike.

The Role of Policy in Driving Automotive Industry Recovery

Government policies and international trade agreements play a significant role in shaping the automotive industry landscape. The recent withdrawal of US tariffs against European countries has been heralded as a critical factor enabling the recovery of the automotive sector. Policymakers are increasingly recognizing the importance of the automotive industry as a major economic driver, and their actions can either bolster growth or hinder progress. The focus on reducing trade barriers has the potential to stimulate investment, bolster sales, and foster innovations within the automotive space.

Additionally, the balance between ensuring fair trade practices and supporting domestic manufacturers poses a considerable challenge for policymakers. As the US seeks to protect its automotive interests, it must also consider the implications for international partners. Failure to navigate this delicate equilibrium could result in a stifling of competition and innovation within the global automotive market. Therefore, a clear understanding of how policy decisions directly impact both manufacturer successes and consumer choices is essential for fostering a thriving automotive landscape that benefits all stakeholders.

Investor Sentiment in the Automotive Sector: A Closer Look

Investor sentiment within the automotive sector is shifting dynamically in response to the evolving political and economic landscape. The removal of US tariffs has tapped into a broader sense of optimism, as market participants perceive an opportunity for growth following a tumultuous period. Automotive stocks are leading this recovery, and investor interest is rekindling alongside hopes of increased vehicle sales and stabilization within the industry. The improvement in Volkswagen’s stock performance emphasizes how critical investor sentiment is in determining market trajectories.

As financial markets react to external stimuli, the correlation between political developments and stock performance becomes increasingly pronounced. Investors are now paying closer attention to the broader ramifications of trade policies, understanding that tariffs not only affect immediate stock performance but also indicate long-term sustainability in the automotive sector. The enthusiasm surrounding automotive stocks is a reflection of the industry’s potential turnaround, and sustained positive sentiment could pave the way for further investments and innovations necessary for embracing the future of mobility.

Conclusion: Navigating the Road Ahead for the Automotive Industry

As the automotive industry embarks on a path of recovery following recent tariff adjustments, the road ahead remains fraught with challenges and opportunities. Manufacturers must continue to innovate and adapt to market demands while navigating the complexities of international trade policies. The significant gains seen in automotive stocks underscore the optimism reflected in investor sentiment, but sustainable growth requires ongoing commitment to efficiency and reform. The dual focus on profitability and transformative practices will be vital as the industry transitions toward a more sustainable and competitive future.

In conclusion, the automotive industry’s recovery is a multifaceted journey impacted by local and global dynamics. While major manufacturers appear to be weathering the storm, the underlying challenges faced by suppliers emphasize the need for cohesive strategies that promote stability throughout the supply chain. Balancing operational efficiency with a responsive approach to market changes will be key in determining how effectively the automotive sector can capitalize on newfound opportunities as it navigates the evolving landscape of global trade.

Frequently Asked Questions

What is the impact of US tariffs on the automotive industry?

US tariffs have significantly impacted the automotive industry, especially for export-oriented manufacturers. Tariffs on imports, especially a blanket 15% duty on cars from the EU, have increased costs, leading to concerns over profitability and competitiveness. However, the recent withdrawal of these tariffs has provided relief, indicating a potential recovery for automotive stocks.

How do US tariffs affect automotive stocks in the market?

US tariffs directly influence automotive stocks by impacting production costs and profitability. When tariffs are imposed, automotive stocks often suffer as investors anticipate reduced margins for manufacturers. Conversely, with the recent relaxation of tariff policies, automotive stocks have shown recovery, as observed in significant gains of companies like Volkswagen and BMW.

What does the automotive industry recovery look like after the withdrawal of US tariffs?

The automotive industry recovery following the withdrawal of US tariffs is marked by a rebound in stock prices and improved investor sentiment. Companies like Volkswagen reported unexpected cash inflows, boosting confidence. Despite challenges like declining sales in China and transitioning to electric vehicles, the sector is showing signs of resilience and potential growth.

How are European car sales impacted by US tariffs?

European car sales have been adversely impacted by US tariffs, particularly due to rising import duties. Such tariffs increase the cost of exporting vehicles to the US market, leading to reduced demand and sales figures for European manufacturers. However, with the recent easing of these tariffs, there is hope for a recovery in European car sales.

What are the implications for Volkswagen stock performance in light of US tariffs?

Volkswagen’s stock performance has been positively impacted by the withdrawal of US tariffs, reflecting increased investor confidence. The company reported strong cash inflow expectations, which contributed to its stock rising significantly. As the automotive industry recovers, Volkswagen’s resilience despite external pressures, such as tariffs, positions it favorably in the market.

What challenges do German automakers face despite recovering from US tariffs?

Despite recovering from US tariffs, German automakers face several challenges, including declining sales in critical markets like China and the ongoing transition to electric vehicles. These factors demand cost-cutting measures and adaptation to new technological trends. While major manufacturers remain profitable, their suppliers are experiencing more critical issues, highlighting the need for comprehensive strategies within the industry.

What role do US tariffs play in the broader context of the automotive industry’s transformation?

US tariffs play a crucial role in the automotive industry’s transformation as they affect production costs and international competitiveness. The need to adapt to changing market forces, including a shift towards electrification and digitalization, is further complicated by tariff policies. The current easing of tariffs signifies a potential shift towards more stable conditions for manufacturers to innovate and recapture market opportunities.

| Key Point | Details |

|---|---|

| Withdrawal of US tariffs | Provided relief to the markets, especially benefiting the export-oriented automotive industry. |

| Impact on automotive stocks | Automotive stocks showed recovery, with gains of up to 3.4% after fears of new tariffs subsided. |

| Tariffs on EU cars | A previous tariff of 27.5% had a serious potential impact; the current import duty is 15%. |

| Volkswagen’s cash inflow | Volkswagen reported a higher-than-expected cash inflow for 2025, aiding their stock performance. |

| Challenges for suppliers | Many auto parts suppliers are struggling due to increased competition and shifts toward electric vehicles. |

| Overall market reaction | The DAX rose amidst the news of tariff withdrawals, reflecting broader market relief. |

| General automotive industry health | Despite challenges, major manufacturers are not in crisis as they continue to post profits and pay dividends. |

Summary

US tariffs and the automotive industry have seen a recent shift with the withdrawal of potential import duties, offering significant relief to an industry that had been reeling from potential new tariffs. Automotive stocks are recovering as the fear of high tariffs has diminished, leading to increased investor confidence. Major companies like Volkswagen are experiencing unexpected cash inflows, indicating resilience despite challenging market conditions. While the overall automotive market faces pressures from competitors and shifts towards electrification, manufacturers remain profitable, suggesting that while prompt actions are required, the industry is currently navigating its challenges without sliding into a full-blown crisis.